Top 10 Tips on Making the Most of Banking CRM

Updated on

Updated on

By Bradley Kovacs

By Bradley Kovacs

Bradley Kovacs

Bradley has been passionate about technology since childhood, starting with Microsoft Flight Simulator at age six. In college, he automated his data e...

learn more

Bradley Kovacs

Bradley has been passionate about technology since childhood, starting with Microsoft Flight Simulator at age six. In college, he automated his data e...

Table of Contents

Table of Contents

These days, people have more options than ever before when it comes to banking.

Picture this: you own a financial institution in a small town, where just a handful of years ago, it was the only choice that the residents had when it came to banking.

But that's no longer the case.

The majority of banking transactions that most people use every day, like opening a new account, transferring money, and paying bills can be done online through a computer or mobile device. This means that the small town bank no longer has the same hold on the residents like it did before.

People have choices.

If you're not providing the customer service experience they expect, they don't give a second thought to packing it up and leaving for greener pastures.

Finance is an old industry, but that doesn't mean it's been resistant to modern processes.

Technologies like blockchain, chatbots, and Artificial Intelligence (AI) have become the norm in the financial services industry, as these technologies increase security, free up hundreds of hours of work time, and overall help provide a better customer experience.

But a banking CRM is like the core behind all of these technologies,

Introduction to CRM in Banking

CRM stands for Customer Relationship Management, which is arguably the most important factor of business success for the financial services industry (aside from being able to manage someone's money properly, of course).

Customers are increasingly expecting more personalized experiences, and the financial industry isn't immune to that fact. Banks need to be able to show their customers that they can answer their personal financial questions, provide tailored solutions, and overall just showcase a complete understanding of their unique financial needs.

And the above holds true whether it's a consumer banking customer or a business banking customer: seamless and personalized experiences are expected and extremely important for winning new customers and retaining existing ones.

A CRM in banking can help you provide that tailored experience your customers expect, while at the same time making your life easier by automating processes and making data easy to manage and access, while still maintaining a level of high security.

Considering that a CRM is among the top three tools for creating personalized customer interactions, leading to increased customer loyalty and marketing ROI, it's no wonder that the financial industry is adopting CRM usage faster than ever before.

Tips for Maximizing Your Banking CRM

It's clear that banking CRM software is a given for any size financial institution. While a banking CRM is a great tool out of the box, there are certain things you can do to make sure that your data stays clean and that you get every benefit possible from the CRM.

Here are several tips on how to maximize the effectiveness of your banking CRM:

1. Integrate With Third-Party Software

Many CRMs can be integrated with third-party software to increase functionality. In some cases, you can even integrate your banking CRM software with industry tools such as eMoney and Riskalyze, which alongside tools like Google Calendar, Gmail, and Outlook can quickly stack up to provide the functionality to your CRM that you didn't think was possible.

Ringy comes with the ability to integrate with Google Calendar and Facebook immediately. Ringy can also integrate with Zapier to open the CRM up to further integration with hundreds of other pieces of software.

2. Use CRM Security Features

Obviously, in the banking industry, privacy and security are extremely important. Customers should feel confident that they have their sensitive information secured and protected.

Thankfully, most banking CRMs provide essential security features, such as:

- Role level access

- User activity logs

- Compliance with data privacy regulations (GLBA, GDPR, etc.)

Role level access allows you to control who can view what data, depending on their role within the company. Using this feature is important to reduce the number of eyes that see certain information, which allows you to both keep better track of who had access to what in the case of a data breach and control the likelihood of potential data breaches.

User activity logs are a great way to keep track of the movement in and out of customer accounts and allow you to quickly identify actions that need to be looked into. It's also great for training new employees or fixing errors.

Compliance with data privacy regulations is paramount to a secure banking CRM. Most modern CRMs are in compliance with GLBA (United States) and GDPR (Europe).

3. Learn From Reporting and Analytics

Most banking CRMs, Ringy included, provide reporting and analytics so you can easily gather information about your employees' performance, customer activity, and more to provide context to your business's performance.

You can then use this information to adjust processes, determine KPIs, and identify opportunities to improve your business.

4. Use Purchase History for Upselling Opportunities

Upselling is when you offer another product or service that adds value in some way to a customer's existing purchase. One way to do this is to look at purchase history in your banking CRM to determine if there are complementary products or services that a customer could benefit from.

Not only does upselling increase ARPU (Average Revenue Per Customer), it's also good customer service to offer additional beneficial products that the customer may not have been aware of before.

5. Ensure Customer Information Is up to Date

Keeping customer information accurate and up to date in your banking CRM is extremely important. Duplicate and disconnected customer data lead to problems throughout your sales pipeline, from marketing to sales to customer service.

Ensuring that reps from all departments take the time to accurately enter customer information goes a long way in keeping your data clean. There are also third-party applications and software solutions that you can add to your CRM to help keep customer data accurate, many of which can be found through Zapier.

6. Segment Your Customer Base

One of the most powerful features of a banking CRM is its ability to segment your customer base. By categorizing customers based on account types, spending habits, or their lifecycle stages, you can deliver services and marketing campaigns that resonate with specific groups.

For example, investment banking CRM software can help identify high-net-worth individuals and offer them tailored investment solutions.

Similarly, a CRM for loan officers can group customers interested in mortgages or personal loans, enabling more targeted follow-ups. Proper segmentation ensures your resources are efficiently allocated and customers feel valued through personalized interactions.

7. Personalize Customer Interactions

Today's customers expect a personalized banking experience, and this is where your CRM in banking becomes a vital tool. You can use the data stored in your banking CRM software—such as transaction history, preferences, and lifecycle stage—to customize communications. For instance, sending birthday greetings, offering loan products suited to a customer's financial profile, or suggesting investment plans based on past behavior builds stronger relationships.

Banks that use advanced CRM systems can also craft highly relevant email campaigns or even in-app notifications, creating a seamless customer journey.

8. Automate Routine Tasks

Repetitive administrative tasks can be a drain on productivity, but with automation features in your CRM for banking industry, you can streamline operations. Automate follow-ups, schedule appointments, and even handle data entry, freeing up your team to focus on high-value tasks like relationship building and customer retention.

Automation also minimizes human error, ensuring accuracy in sensitive banking processes. For example, a CRM for loan officers can automatically remind prospects of upcoming document submissions, while an investment banking CRM can schedule periodic portfolio reviews without manual intervention.

9. Train Your Team Regularly

A banking CRM system is only as effective as the team using it. Regular training sessions help employees understand the full scope of the software, from basic features to advanced tools.

Here are some of the benefits of training your team regularly:

|

Benefits |

Description |

|

Increased User Adoption |

Regular training encourages team members to actively use the CRM for loan officers or other relevant banking CRM tools. |

|

Improved Data Quality |

Training helps ensure that data is entered accurately and consistently. |

|

Enhanced Team Collaboration |

Training can facilitate better communication and collaboration among team members. |

10. Set Up Alerts for Key Customer Activities

Configure your investment banking CRM software to send alerts for significant customer activities, such as large withdrawals, account inactivity, or account anniversaries.

Benefits include:

|

Benefits |

Description |

|

Proactive Customer Service |

Alerts enable you to address customer concerns proactively or offer timely assistance. |

|

Improved Risk Management |

Alerts can help identify and mitigate potential risks, such as fraudulent activity. |

|

By proactively engaging with customers, you can strengthen relationships and reduce customer churn. |

When you implement these tips, you can effectively use your banking CRM to improve customer relationships, enhance operational efficiency, and drive business growth.

How to Choose the Best Banking CRM

When you're choosing a banking CRM, you should keep in mind what key outcomes you are looking for once the CRM is implemented, everyone is onboarded, and your data is 100% integrated into the CRM.

These key outcomes could include financial and productivity gains, such as:

- Increased sale volumes

- Increased upsell and cross-sell volumes

- Increased revenue

- Less time spent on solving customer issues

- Less time spent on administrative tasks

- More marketing communications are being sent due to automation

- Better customer relationships

Once you determine your key outcomes, you're better prepared to choose a CRM that can help you meet those expectations. But there are so many options out there, it can be difficult to narrow down your choices.

Not to worry, we've got you covered.

The next section summarizes our top picks for the best banking CRM software available today.

Top Banking CRM Software

To start off with, let's go through the criteria we're using to choose our top bank CRM picks. We're looking at things like:

- Price

- Features (automation, lead generation, security)

- Reporting and analytics capabilities

- Security (role access, user activity logs, GLBA and GDPR compliance)

With these factors in mind, let's take a look at our choices for top banking CRM software:

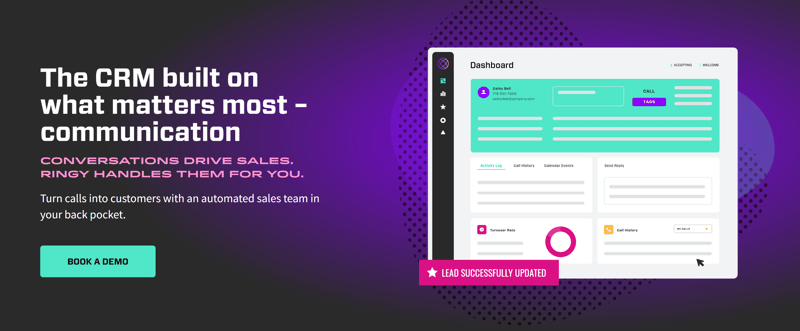

1. Ringy

Yeah, we're recommending Ringy as one of our top choices. Ringy is an excellent entry-level CRM with unmatched customer support. Our CRM also provides specific features that are tailored to finance professionals.

Features

- Excellent customer support, which is included in all plans

- Onboarding included

- Cloud-based CRM

- Subscription includes unlimited users

- Specific features that support the financial services industry (e.g. follow-up scheduling, softphone, click-to-call)

- Mobile CRM version to support sales reps on the go

- Analytics and reporting

- Sales pipeline management

- Lead management including lead “buckets” to prioritize incoming leads, and a lead dashboard

- 360-degree agent dashboards

- Ability to add third-party integrations immediately (e.g. Zapier, Facebook, Google Calendar)

- GLBA and GDPR compliance

Pricing

- Free trial included when you sign up

- $119 per month for unlimited users and includes all CRM features

- No contracts

- No additional cost for support

*Pricing as of January 2026

2. Creatio (Sales)

Creatio is a straightforward CRM with sales, marketing, and service hubs (sold separately from each other).

Features

- 360-degree customer views

- Cloud or on-site CRM

- Specific features that support the financial services industry (e.g. follow-up scheduling, softphone)

- Lead management features such as segmentation and leads capturing

- Sales pipeline and process management

- Mobile version to support sales reps on the go

- Access to the Creatio marketplace for simple third-party application integrations

- GLBA and GDPR compliance

Pricing

- Free trial included with sign-up

- Sales CRM Subscription pricing starts at USD $25 per user per month

- The marketing and service CRMs are sold separately

- Extra support cost is required with all plans

*Pricing as of January 2025

3. Engagebay (CRM & Sales Bay)

Engagebay offers a well-rounded and affordable banking CRM software solution. Sales, marketing, and service features are sold separately as “bays” or available as an all-in-one package.

Features

- 360-degree customer views

- Variety of third-party app integrations

- WordPress plugin

- Lots of online lead generation features (e.g. landing pages, tag management, lead scoring, web pop-ups)

- Social suite (Twitter, Facebook & Instagram)

- Analytics and reporting

- Gmail and Outlook integration

- GLBA and GDPR compliance

Pricing

- Free trial included with sign up

- Monthly, annual, and biannual pricing available

- Offers a free plan, paid plan (for the CRM & Sales bay) starts at USD $12.99 per user per month for the monthly paid option

- Free migration service offered if you're switching to Engagebay from another platform

*Pricing as of January 2025

4. Investglass.com

Investglass is a CRM made for the finance, healthcare, and insurance industries. The software includes a variety of templates that you can use to customize your user interface to meet your needs.

Features

- Sales automation tools such as automatic record updates, approval processes, and more

- Create tasks and follow-up actions

- Lead generation forms

- Digital document vault for sharing and storing important documents

- Portfolio management

- Accounts dashboard to view customer information

- Basic automated email system

- Sales pipeline management

- GLBA and GDPR compliance

Pricing

- Starts at $55 per user per month

- Starter plan limits available features; additional features available in higher-tier plans

*Pricing as of January 2025

5. Monday.com

If you need comprehensive scheduling for your team, Monday.com is a great choice. While Monday is a project management software at heart, The CRM template offers enough options to satisfy most user needs.

Features

- Highly visual collaboration boards with colour coding options

- Lead capturing

- Sales pipeline management

- Revenue forecasting

- Sales automations

- Reporting and analytics

- Ability to integrate with third-party applications

- GLBA and GDPR compliance

Pricing

- Free plan available with no time limit (unlimited free trial)

- Monthly and annual pricing options

- Starts at $12 per user per month

*Pricing as of January 2025

6. Zendesk Sell

Zendesk sell is a sales-focused CRM that is designed to enhance productivity for sales teams within any industry, including financial services.

Features

- Sales pipeline management

- Specific features that support the financial services industry (e.g. follow-up scheduling, softphone, click-to-call

- Fully mobile CRM to support sales reps on the go

- Third-party integrations are available

- Reporting and analytics

- GLBA and GDPR compliance

Pricing

- The Zendesk Sell plans start at $55 per agent/month billed annually

*Pricing as of January 2025

Conclusion

If you work in the financial services industry and want to provide tailored and personalized customer experiences, investing in a Banking CRM is a necessity.

These days, customers expect you to completely understand their pain points, needs and wants with every interaction they have with you and your company.

A CRM for banks allows you and your employees to have immediate access to all communications and data that your company has gathered from that customer so reps can be completely prepared for every interaction, every time.

Ringy is a great banking CRM that has all the features financial professionals need to keep their customers happy and well looked after.

Ready to get started? Book a demo with us today and we'll walk you through our software.

Skyrocket your sales with the CRM that does it all.

Calling? Check. SMS? Check. Automation and AI? Check. Effortlessly keep in touch with your customers and boost your revenue without limits.

Take your sales to new heights with Ringy.

Sales in a slump? Ringy gives you the tools and flexibility you need to capture leads, engage with them, and turn them into customers.

Subscribe to Our Blog

Enter your email to get the latest updates sent straight to your inbox!

Categories

Related Articles