A Guide to CRM for Banking [Features, Benefits, Cost & Top 5]

Updated on

Updated on

By Katie Bowman

By Katie Bowman

Katie Bowman

Katie has extensive experience in customer service and enjoys the opportunity to help others. She is committed to providing high-quality service and d...

learn more

Katie Bowman

Katie has extensive experience in customer service and enjoys the opportunity to help others. She is committed to providing high-quality service and d...

Table of Contents

Table of Contents

So your job as a bank customer service rep is to reach out to clients in a timely way.

But you haven't. And your operations manager isn't happy.

If only you had a system to remind you when it's time to reach out to a client or prospect.

Now you wish you had a database to quickly check client and prospect data.

Well, CRM for banking helps you coordinate client outreach, maintain sales pipelines, conduct account analysis, and more.

Today we give you the skinny on CRM banking software, how it'll benefit you, and the top three CRM banking tools.

What Is a CRM for Banking?

Like in all other industries, customer relationship management for banking is a consolidated system that integrates with your other banking software and gives you a single view of every customer's account.

When using a bank CRM, you organize your bank's leads and customers to allow sales and marketing teams to connect with them directly or through campaigns.

Your CRM is tailored to help your bank implement customer-centric strategies. Bank staff can:

- Store customer data

- Schedule appointments

- Send personalized emails

- Lift their productivity

- Visualize and manage leads

- Update customer profiles on the spot

- Create reports

Why Should You Use CRM Bank Software?

Let's look into five reasons to consider when using a banking CRM.

1. Increased Productivity

40% of workers spend a quarter of their week on mundane tasks. CRMs take away these repetitive admin tasks, letting you focus on what matters.

Productivity for bank reps is spending more time doing high-value activities like closing deals, follow-ups, and prospecting.

CRM features like auto-dialers boost productivity by screening out negative calls and voicemails.

Also, CRMs help in lead scoring. This saves bank reps' time and focuses them on warm leads. They close more sales within a short time.

Email drip campaigns run by the CRM for banking do the lead nurturing. This allows your sales team to call more clients than they would if they had to send out the emails themselves.

2. Increased Lead Conversion

Lead conversion in banking means winning a new client from your competitors or upselling and cross-selling to an existing customer.

Lack of human touch can compromise conversion. Your customers may want to speak to an agent about an issue rather than read about the solution or process a request online.

44% of companies say their sales staff is too busy to follow up. But only 25% of these use a lead conversion solution – or CRM.

Banking CRM software lets you follow up with clients through automated drip campaigns. This boosts lead conversion and increases sales.

3. Better Communication with Customers

The goal of this communication is to solve a problem with your services. Quick responses also let them know you care for their needs.

50% of customers still buy from the first company to respond to their query. Your bank CRM will send automated responses to clients and notify bank reps to follow up asap!

Other CRM features that boost communication are:

- Centralized notes help bank staff pick up on previous conversations

- Email and SMS drip campaigns help you nurture leads

- Prompt, streamlined responses

Ultimately, no leads fall through the cracks because of data mix-ups.

4. Enhanced Brand Image Online

Customers perceive strong bank brands as lower risk and higher value. This builds customer trust.

In this content-driven online world, make your bank brand a helpful resource to each customer and their unique needs.

You'd be interested to know that 48% of bank customers want preferential treatment and rewards in exchange for bank brand loyalty.

With banking CRM, you can consistently send out high-quality newsletters with branded imagery to your leads. This builds brand awareness and nurtures prospects between sales calls.

5. Inter-Departmental Data Accessibility

Banking CRM software tracks and updates conversations and information across all departments in real-time.

Meaning that specific bank staff members can log in to the bank CRM database to access relevant data. This allows departments to use each other's knowledge to close sales.

For instance, calls between your bank reps and customers can help the marketing department track user behaviors that lead to conversion. They can then leverage this in the bank's marketing strategy.

What Features Should You Consider in a CRM for Banks?

An effective CRM for banking should have these five features:

1. Contact Management

Your customers have multiple banking options. High-quality customer service is key to boosting customer experience and retaining your bank's customers.

So, your banking CRM should help your bank to keep track of new and existing clients.

The contact management software feature of the CRM should show each customer's position in the buyer journey, along with their previous interactions with your bank.

An accessible, searchable database will help you and your team to improve internal communications and contact management. This gets the team more organized and able to cater to each customer's needs.

2. Lead Tracking

A CRM for banking will let you analyze which leads are generating interest in your loans, mortgages, overdrafts, and other services.

You can then use this data to target them with relevant marketing campaigns and push them toward purchasing.

Let's say, for example, a customer calls a bank rep to ask about the car loans the bank offers. The rep advises on the financing percentages, the loan tenure, and more.

The customer says they'll call back after they make a decision. The bank rep makes notes of the customer's interests and feeds the lead's details into an automated email drip campaign focusing on car loan offerings.

This pipeline management helps in nurturing and converting more leads into paying clients.

3. Data Security

Any data collected by the CRM banking software needs to be competently encrypted. If you notice a potential security risk, it's time to change or enhance your systems.

To boost your security efforts, have your bank CRM software run on a secure server with tight points of entry.

Also, keep your CRM up to date. Updates usually have advanced safety features and deeper data protection.

4. Integration

CRM banking software that integrates with your bank website, email, and the phone will make work super easy for you to manage all your contacts on a single, unified database.

Look out for more integrations like social media management, web analytics, and other third-party integrations.

Integration kills the inconvenience of switching between apps during your daily work.

5. Reports and Analytics

Your banking CRM should generate comprehensive analytics to help you to gauge the productivity and performance of your bank's customer service team.

Note that these reports are based on the activities that have been logged onto the banking CRM system. These activities can be the number of daily emails or calls or customer reviews the bank got in the past month.

The analytics can be useful when forecasting and discussing how to improve customer service moving forward.

6. Automation and Artificial Intelligence

The banking sector is ripe for automation, and a CRM equipped with artificial intelligence (AI) can be a game-changer. A CRM for banks that leverages AI can automate various tasks, freeing up valuable time for your staff and enhancing the customer experience. Here's how:

- AI-Powered Chatbots: These virtual assistants can handle routine inquiries, answer frequently asked questions, and even schedule appointments, all while freeing up human representatives for more complex customer interactions.

- Automated Lead Scoring and Prioritization: A CRM for banks with built-in AI can analyze a customer's financial history, spending habits, and even social media interactions (with permission) to create a more complete picture and identify potential needs.

- Predictive Analytics: AI can analyze past data to predict customer behavior and identify potential risks. For example, a CRM for banking might use AI to flag a customer at risk of missing a loan payment, allowing the bank to take proactive steps to prevent delinquency.

- Personalized recommendations: AI can analyze customer data to recommend products and services tailored to individual needs, which can increase customer satisfaction and loyalty.

Bank CRM Software Costs

Here's a breakdown of what it might cost you to get effective bank CRM software:

|

Bank Size |

Cost |

|

Small Banks and finance institutions |

From $12 per user monthly |

|

Mid-level banks and finance institutions |

$50 - $150 per user monthly |

|

Enterprise-level banks and finance institutions |

From $300 per user monthly |

And here are the details:

- You can get a paid banking CRM for anywhere from $12 per user monthly for small banks and financial institutions.

- If yours is a mid-level to large bank enterprise, it may cost you between $50-$150 per user per month.

- The most expensive CRMs for banking charge $300 per user monthly or more - these are great for enterprise-level banks and financial institutions that have multiple branches and thousands of employees in many locations.

The majority of CRMs for banking receive payments on an annual basis. This means that once you pick a bank CRM package, you pay for the entire year before you begin using it.

You can also find free plans. But these come with restricted feature access and low data storage capabilities.

Free plans can be great for a startup but are not the best fit for growing banks.

The 5 Best CRM Banking Software on the Market

Now, we give you a list of four superb CRM software for banking.

But first, a breakdown:

|

Tool |

In one sentence |

Monthly Pricing (per user) |

|

Ringy |

Full-scale calling and SMS suite |

From $119 |

|

Creatio |

Easy to customize workflows |

From $25 |

|

Salesforce Financial Services Cloud |

Intuitive and easy-to-use dashboards |

From $250 |

|

Microsoft Dynamics 365 |

A flexible CRM solution that integrates seamlessly with other Microsoft products |

From $180 |

|

Freshworks CRM |

A combination of user-friendliness, advanced features, and a focus on AI assistance |

From $9 |

Now let's dive in.

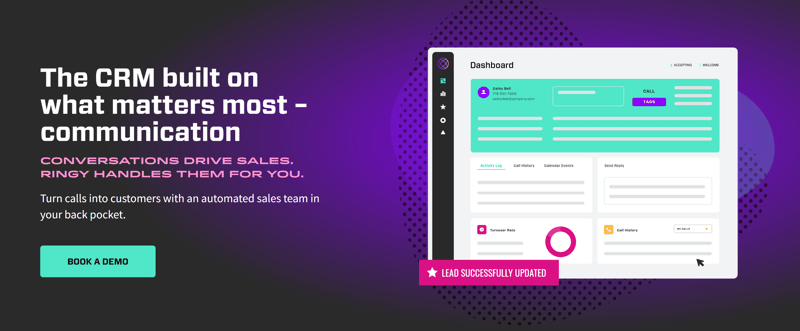

1. Ringy

Ringy is a CRM that helps you bridge the gap between lead nurturing and closing the sale. It focuses on actionable insights and automation, saving you valuable time.

Ringy gives you follow-up reminders. This lets you stay in front of serious bank service prospects and keep track of appointments or callbacks with clients.

You can set automated emails and text messages to go out to new banking leads and connect with them immediately.

Automated follow-up frees up your bank reps' time. They can then spend more time prospecting and calling clients. What's more, you get all your calls routed to your cell when you're away from your computer.

The two-factor authentication, single sign-on, and 24/7 customer support add a firm layer of security to your bank's data.

Ringy's priced at $119/month and offers a 7-day free trial.

*Pricing as of May 2024

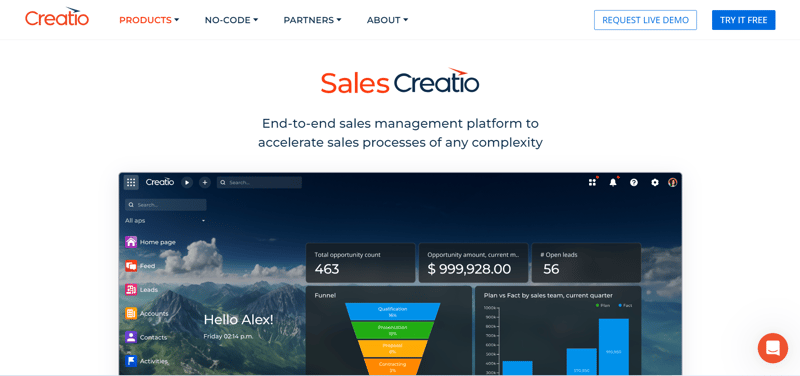

2. Creatio

Creatio lets you create customized workflows that cater to your bank's needs without bothering the bank's tech guy. No coding knowledge is needed.

Updating the business process is super easy, as the needs of each client evolve over time. This means that your bank can adapt to changes in the financial industry in a jiffy as they come.

Communicating with your teammates becomes easier using Creativo's BPM online tools, which have omnichannel capabilities. All client data is recorded in one location.

This helps synchronize the work of all your bank's departments. Everyone can access client information whenever they need to.

Creatio is pricing starts at $25/user monthly and offers a 14-day free trial.

*Pricing as of May 2024

3. Salesforce Financial Services Cloud

Salesforce Financial Services Cloud is an intuitive platform that allows users to quickly access customer data with a few clicks. Its drop-and-drag system speeds up work processes.

Its simple and accessible layout lets you organize and maintain all your leads. For instance, you can easily run all your bank's loan management on the platform and scroll through or search to find the needed data.

Salesforce has several features that can be confusing. You may need a Salesforce rep to help you set up and run the banking CRM.

However, you get 24/7 support and lots of learning material, such as webinars, documentation, and live lessons.

Salesforce Financial Service Cloud is priced at $250/user monthly and offers a 30-day free trial.

*Pricing as of May 2024

4. Microsoft Dynamics 365

Another industry leader, Microsoft Dynamics 365 offers a flexible CRM solution that integrates seamlessly with other Microsoft products your bank might already use. This CRM for banks provides features for lead nurturing, customer segmentation, and reporting and analytics.

Like Salesforce, Dynamics 365 prioritizes security, giving banks peace of mind when managing customer information.

Microsoft Dynamics 365's pricing starts at $180 per user per month, and there is a 30-day free trial.

*Pricing as of May 2024

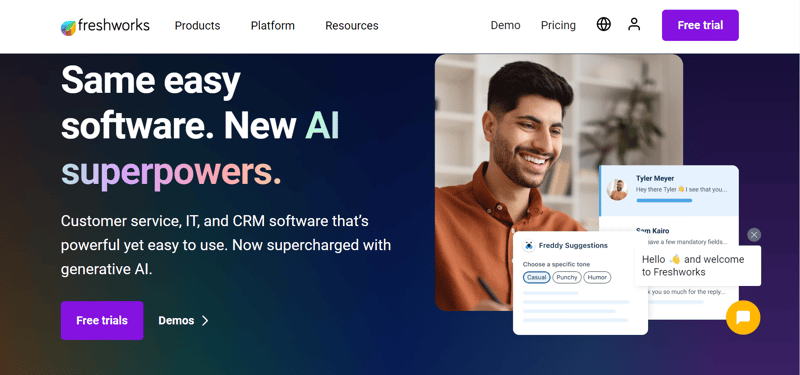

5. Freshworks CRM

This AI-powered CRM is known for its user-friendly interface and innovative features tailored for the banking sector. Freshworks CRM offers features like:

- 360-degree customer view: Provides a holistic perspective of each customer, including account information, past interactions, and financial data.

- Predictive lead scoring: Uses AI to identify high-value leads and prioritize outreach efforts.

- Smart automation: Automates repetitive tasks like data entry and appointment scheduling, freeing up valuable time for relationship managers.

- Built-in telephony: Enables seamless integration with your bank's phone system for efficient call management.

As far as pricing is concerned, Freshworks CRM starts at $9 per user per month, and there's also a 21-day free trial.

*Pricing as of May 2024

Future Trends in CRM Banking Software

The future of CRM for banks is brimming with exciting possibilities. Here's a look at some key trends that will shape the industry:

1. Increased Use of Artificial Intelligence and Machine Learning (AI/ML)

AI and ML will play an even bigger role in CRM for banks. We'll see more sophisticated chatbots capable of handling complex inquiries, AI-powered lead scoring for better targeting, and automated risk assessments to ensure financial security.

Machine learning will further personalize the customer experience by analyzing data to predict needs and recommend relevant products or services.

2. Data Analytics and Big Data

Banks have a treasure trove of customer data. Advanced analytics tools will help them unlock their true potential, allowing for deeper customer insights, improved product development, and targeted marketing campaigns. By leveraging big data, banks can gain a 360-degree view of their customers and tailor their offerings accordingly.

3. Blockchain for Security and Trust

Blockchain technology offers a secure and transparent way to store and share data. This could revolutionize CRM for banks by enhancing data security and building trust with customers. Imagine a system where customer information is securely stored on a blockchain, accessible only by authorized parties. This would not only improve security but also empower customers with greater control over their data.

4. Omnichannel Customer Experience

Customers today expect a seamless experience across all touchpoints, whether it's mobile banking, online chat, or in-person visits. Future CRM for banks will prioritize omnichannel integration, allowing customers to switch between channels seamlessly while maintaining context. This means a customer who starts a conversation with a chatbot can continue it with a live representative without losing track of the issue.

5. Regulatory Technology (RegTech)

The financial sector is heavily regulated, and compliance is a major concern. RegTech solutions will become increasingly integrated with CRM for banks, helping them stay compliant with ever-changing regulations.

This could involve automated reporting, risk management tools, and customer onboarding processes that streamline compliance while reducing errors.

6. Predictive Customer Service

CRM for banks will leverage AI and data analytics to predict customer needs and proactively offer support. Imagine a system that alerts bank staff about significant life events for a customer, like a marriage or home purchase. This would allow the bank to proactively suggest financial products or services tailored to these events, demonstrating a deeper understanding of the customer's life journey.

7. Voice and Conversational User Interfaces (VUIs)

The rise of voice assistants like Siri and Alexa is paving the way for voice-enabled CRM solutions. Imagine a customer asking their smartphone for account information or initiating a money transfer. Future CRM for banks will integrate with VUIs, offering a more natural and convenient way for customers to interact with their bank.

Conclusion

A CRM for banking is a consolidated system that integrates with your other banking software, giving you a single view of every customer's account.

Adopting a CRM for banking helps you improve bank staff productivity, increase lead conversion, allow better communication with bank customers, interdepartmental data accessibility, and enhance brand image online.

Ringy is an awesome fit for banks because it gives you automated text and email send-outs, callback and appointment reminders, tight data security, and more.

If you're looking for great banking CRM software, request a demo with Ringy and put our system to the test.

Skyrocket your sales with the CRM that does it all.

Calling? Check. SMS? Check. Automation and AI? Check. Effortlessly keep in touch with your customers and boost your revenue without limits.

Take your sales to new heights with Ringy.

Sales in a slump? Ringy gives you the tools and flexibility you need to capture leads, engage with them, and turn them into customers.

Subscribe to Our Blog

Enter your email to get the latest updates sent straight to your inbox!

Categories

Related Articles