CRM for Financial Advisors - 5 Reasons Why You Should Use It

Updated on

Updated on

By Katie Bowman

By Katie Bowman

Katie Bowman

Katie has extensive experience in customer service and enjoys the opportunity to help others. She is committed to providing high-quality service and d...

learn more

Katie Bowman

Katie has extensive experience in customer service and enjoys the opportunity to help others. She is committed to providing high-quality service and d...

Table of Contents

Table of Contents

Have you finally grown tired of:

Rushing around and collecting information like a madman?

Struggling with complex IT systems?

Using a patch-job CRM that's just not built for finance professionals?

We get you, it's a nightmare.

You already work long enough hours without having to lose sleep over software that should be called HARD-ware.

And the fact that you know it's completely unnecessary makes it worse. Or does it make it better?

We think so, and not just because we're an optimistic bunch...

But also because it means a solution for your problems is just around the corner.

After all, you work in an industry with yearly revenues of $6.0tr in the US alone - smart people want to help you succeed.

So what's the answer to your frustrations?

A CRM built explicitly for financial services by workflow experts and developers who understand the ins and outs of your business.

Sound interesting?

Then keep reading, and you'll learn:

- What CRMs are

- The five main reasons why you need a CRM for financial advisors in 2024

- The five best solutions available on the market

It'll be a 20 to 25-minute investment that'll save you at least that amount of time every day for the rest of your career.

What Is CRM Software? And What Is Financial CRM Software?

CRM (or customer relationship management) software is widespread across all industries - the latest stats say that nearly 85% of businesses use some form of CRM.

That's impressive, especially if you consider how long their journey has been.

It all started back in the 1950s with the introduction of the famous Rolodex.

Who could forget that little beauty?

Well, modern CRMs are quite a step up.

They do a lot more than just store names and notes.

If we had to define a CRM system, we'd say it's a tool that helps companies organize, access, manage, and leverage their customer data.

Its super simple goal is to enable better business relationships, which in turn drive better results.

A good CRM achieves this by:

- Centralizing data storage in real-time

- Streamlining processes and automating tedious tasks

- Providing actionable artificial intelligence (AI) and analytics

- Eliminating departmental silos

What Is Financial CRM Software?

But what makes CRM software for the financial services industry different from generic sales CRMs?

That's an excellent question because the differences are subtle and often overlooked.

And looking for a new CRM can quickly get confusing and leave you feeling like you have no idea what to pick.

It happens.

But why is it so hard?

Because the core functionality of all CRM software is similar — they all want to help you better organize your customer data and dazzle your clients.

However, the devil is in the details.

Finance CRM software is specially geared towards the needs of financial advisors, managers, and professionals through the addition of industry-specific functionality.

This level of customization can be achieved by building a finance-only CRM or by adding subsystems or apps that transform a general CRM into an ad-hoc solution.

The key differences you should look out for include:

|

Point of Difference |

Traditional Sales CRM |

CRM for Financial Advisors |

|

Workflows |

|

|

|

Client Profiles |

|

|

|

Reporting |

|

|

|

Integrations |

|

|

Now that you understand what a CRM for financial advisors is, it's time for our favorite part:

The sales pitch.

Get ready for the five reasons why you simply have to invest in this type of technology!

Not to brag, but it's a pretty good pitch.

This makes sense considering everything we know about sales comes from veteran salesman Stanley Hudson:

Now back to business.

What is a Wealth Management CRM?

A wealth management CRM is a software system specifically designed to help financial advisors and wealth management firms manage their client relationships and business operations.

It is a central hub for storing and organizing client data, tracking interactions, managing tasks, and generating reports.

Why use a Wealth Management CRM?

There are many benefits to using a wealth management CRM, including:

- Improved Client Relationships: A CRM can help advisors stay organized and on top of client communications, birthdays, and important dates. It can also help advisors track clients' financial goals, risk tolerance, and investment preferences.

- Increased Productivity: CRM systems can automate many tasks, such as data entry, scheduling appointments, and sending emails. This can free up advisors' time to focus on more important tasks, such as building relationships with clients and providing financial advice.

- Better Business Insights: A CRM can provide advisors with valuable insights into their business, such as which clients are the most profitable or which marketing campaigns are the most effective. This information can be used to make better business decisions.

- Enhanced Compliance: CRM software can help advisors stay compliant with industry regulations by tracking important documents and communications.

Top 8 Reasons To Use CRM Software for Financial Advisors

Financial advisors juggle a lot of responsibilities: managing client portfolios, developing financial plans, staying up-to-date on market trends, and nurturing client relationships. In this complex environment, CRM software can be a game-changer. Here are the top reasons why:

1. Automate Tasks

Financial advisors often get bogged down in repetitive tasks like scheduling appointments, sending follow-up emails, and collecting paperwork. A CRM helps automate these tasks, freeing up your time for more strategic activities. Here are some specific examples:

- Automated Appointment Scheduling: Clients can self-schedule meetings through the CRM, eliminating the need for back-and-forth emails.

- Automated Email Drip Campaigns: Send personalized welcome messages, birthday greetings, and market updates to your clients without lifting a finger.

- Automatic Document Generation: Generate standard reports and proposals with pre-populated client information, saving you valuable time.

2. Keep Information Organized

Financial advisors deal with a mountain of client data, including financial statements, investment holdings, and personal information. A CRM provides a central repository for all this information, making it easy to find what you need, when you need it. This improves accuracy, reduces errors, and streamlines workflows.

- Client Profiles: Create comprehensive profiles for each client, storing all their relevant information in one place.

- Document Management: Securely store and manage important documents like contracts, tax returns, and investment statements.

- Activity Tracking: Log all interactions with clients, including phone calls, emails, and meetings, for a complete historical record.

3. Track Activity and Gain Insights

A CRM goes beyond just storing data; it can analyze it to provide valuable insights into your client relationships and business performance. Here's how:

- Pipeline Management: Track the progress of potential clients through your sales funnel, identifying bottlenecks and opportunities to improve conversion rates.

- Client Segmentation: Group clients based on their needs, risk tolerance, and investment goals, enabling you to deliver personalized communication and recommendations.

- Performance Reporting: Track key metrics like client acquisition costs, average portfolio size, and client satisfaction to measure your success and identify areas for improvement.

4. Streamline Your Workflows

CRMs help you handle important yet repetitive tasks methodically and consistently.

Say goodbye to spending hours trying to find tiny mistakes in enormous custom databases.

What types of activities can you automate and improve?

Here are several ways you can use a financial CRM:

- Account onboarding

- Lead nurturing

- Email or SMS reminders

- Quotes and invoicing

- Claims processing

- Know Your Customer (KYC) verifications

- Portfolio modeling

- Document management

With an algorithmic side-kick by your side, your team will finally be able to spend less time managing routine, low value-adding tasks.

And that'll give you plenty of opportunities to focus on what matters most: having quality conversations with your customers and building rock-solid relationships.

Speaking of relationships, here comes the next reason.

5. Build Stronger Relationships

Who would have guessed, right?

After all, the words ‘customer relationship' are right there hidden in the CRM acronym.

Wealth advisor CRMs empower you to build personalized relationships with your leads and customers without having to sacrifice performance (or all of your free time).

You can look forward to:

- Putting together custom services and packages based on your client's personality, behavior, and assets

- Identifying the perfect upsell and cross-sell opportunities

- Safe and reliable data storage in the cloud

- Tracking and resolving customer pain points

All of these are pivotal for you as a financial advisor because your one-on-one client relationships lie at the very core of your success.

Sometimes relationships matter even more than your returns, especially when the market goes nuts (pandemic, anyone?).

6. Generate and Manage Leads More Efficiently

Selling is a huge part of your day-to-day life.

But to sell effectively, you need to generate warm leads, nurture them through your pipeline, and finally close the deal.

And that's a real challenge. At least according to 58% of business leaders.

So what can you do?

Invest in financial CRM software.

This type of technology helps you systematically track all your lead generation and management activities in a single place.

For maybe the first time ever, everyone in your company will have this valuable data at their fingertips 24/7.

Your entire sales team will know:

- When you first made contact with a prospect

- Their needs and goals

- Their current stage in the sales process

- Potential upselling or cross-selling opportunities

And if your CRM solution has built-in AI, you'll also get customized tips on how to keep your leads moving through the pipeline.

No wonder Salesforce's research shows that firms that adopt CRM systems see a 44% increase in leads and a 37% growth in sales revenue.

7. Learn From the Past

Your business needs data, especially when you work in the world of financial services.

Automation helps you identify patterns, trajectories, and forecasts.

And that's why a CRM with robust analytical capabilities can help you stand out from your competition.

You'll be able to dive into your past performance, understand what works and what doesn't, and make data-driven decisions that maximize ROI.

For example, you could analyze your team's individual sales records and uncover top performers.

Then, you could spend time understanding what motivates their success — maybe by listening to a few recorded sales calls or reviewing the types of leads they're closing.

Once you reveal their secrets, it'll be child's play to roll them out to your entire team and improve your overall success rates.

8. Gain Organization-Wide Visibility

A silo mentality hinders performance and decision-making because it results in business leaders not having the right information when they need it.

A recent study pointed out that a whopping 51% of CEOs blame data silos as a key factor stopping them from making informed decisions.

Ouch.

But the good news is this can become a thing of the past when you properly integrate a CRM for financial advisors into your tech stack.

CRMs offer a centralized, cloud-based view of your company's relationships with its most important assets, your customers.

Leadership teams and executive boards can finally analyze the sales pipeline, past performance, and all the customer data to their hearts' desire.

This bird's eye view will allow them to identify productivity bottlenecks, spot exciting opportunities, and think of innovative ways to take their business forward.

Watch out, better decisions and improved performance incoming!

Key Features of Financial Services CRM Software

Beyond the core aspects of contact management and data organization, features tailor-made for the industry unlock a new level of efficiency and client engagement. Here are some key features of financial services CRM software:

1. Built-in Calling

Seamlessly connect with your clients directly through the CRM platform. CRM for financial advisors, like our very own Ringy, features integrated VoIP calling, eliminating the need to switch between multiple applications and saving you valuable time.

Imagine CRM financial services allowing you to initiate a call directly from a client's profile, instantly connecting with them to discuss their portfolio or answer questions.

This fosters a more personalized and efficient communication experience, strengthening your relationships.

2. Mobile Functionality

Stay connected and productive on the go with wealth management CRM solutions designed for mobile devices. Access client information, update records, schedule meetings, and even initiate calls directly from your smartphone or tablet. This CRM finance feature empowers you to be responsive to client needs and capitalize on opportunities anytime, anywhere.

Whether you're at a client meeting or attending an industry event, CRM advisors ensure you're always just a tap away from delivering exceptional service.

3. Workflow Automation

Simplify repetitive tasks and free up your time for strategic activities with financial services CRM software. Automate tasks like sending follow-up emails, generating reports, and scheduling tasks.

For instance, imagine a financial advisor CRM automatically sending a personalized welcome email after onboarding a new client, saving you time while ensuring a warm introduction. This CRM for financial planners allows you to focus on building meaningful relationships and providing high-touch service.

4. Sales Pipeline and Lead Management

Streamline your client acquisition process with a robust sales pipeline and lead management tools. Effectively track potential clients through each stage of the funnel, identify opportunities to nurture leads, and close deals faster.

Financial CRM software often includes features like lead scoring, qualification tools, and customizable sales stages, allowing you to tailor your approach to each prospect's specific needs. This best CRM for financial advisors helps you convert more leads into loyal clients, boosting your business growth.

5 Best CRM for Financial Advisors

1. Redtail CRM

Redtail CRM is an established player that's been around since 2003.

They've used their headstart wisely, as they've built up an excellent reputation amongst financial advisors and gained the largest market share of any financial CRM.

There's one main reason behind their incredible success:

Redtail CRM is a fairly-priced platform with a super easy-to-use interface.

Users don't face steep learning curves or long battles with customization. Instead, it's as straightforward as signing up, uploading your data, and starting to manage your customer relationships.

But don't think that easy-to-use means that this CRM sacrifices functionality (apart from a lack of VOIP softphone).

You'll still get access to a wide range of features (i.e., workflow automation, lead management, document management) and integrations with popular financial tools.

The two capabilities that make this CRM unique are Redtail University and its seminar management tool. The former offers online classroom-style training, while the latter allows you to organize seminars and use them as lead generation and nurturing tools.

Due to its affordability and easy-to-use features, we have to recognize Redtail Technology as the best CRM for financial services. For the moment. 😊

Monthly cost: Starts at $39 per user/month billed annually for up to 5 users (as of January 2024)

2. Salesforce Financial Services Cloud (FSC)

There's one name in the CRM world that rings louder than everyone else thanks to its 20+ years as an industry pioneer and leader.

Salesforce.

And if you're looking for a wealth management CRM solution for medium or large-sized enterprises, it's a name that you can't afford to leave out of the running.

It's still the most capable and complete CRM tool available in 2024.

Salesforce FSC provides you with cutting-edge software that can be customized in any way you like. From workflow automation to artificial intelligence to over 100 integration possibilities, you'll be able to configure a solution to handle your customer data.

And if that wasn't enough, you'll also get excellent mobile integration, tailor-made tools, and one of the best CRM dashboards in the industry.

So what's the catch?

Salesforce FSC is expensive, labor-intensive to master, and unusually difficult to configure.

To pull it off, you need to have deep pockets and an experienced technical team.

But if these three drawbacks don't make you flinch, Salesforce FSC is the perfect choice for helping your firm create stronger client relationships and increase sales.

Monthly cost: $300 - $475 per user (as of January 2024)

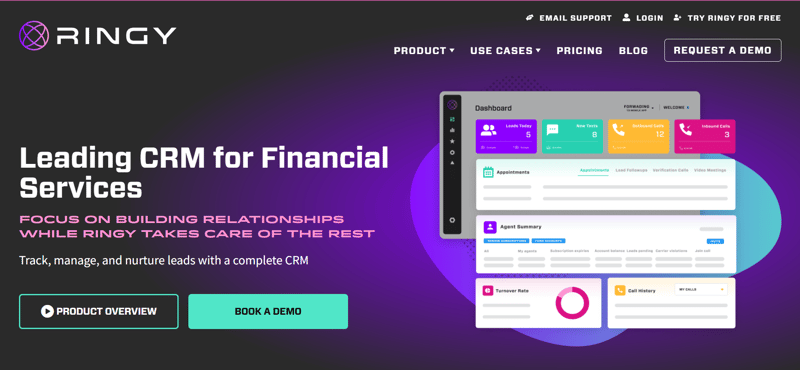

3. Ringy - Work Smarter, Not Harder

The third-best financial advisor CRM software is our very own Ringy.

And before you get the wrong idea, let us just say:

We haven't included our software just because it's ours.

If we wanted to do that, we could have ranked ourselves first and only mentioned our competitors' drawbacks. But that's not our style.

We genuinely believe that our CRM solution is one of the leading options for financial advisors, and we'd love the chance to help you achieve your sales and service targets.

Why do we think we deserve a place up here with the very best in our industry?

Six reasons:

- Cutting-edge sales tools (i.e., powerful automated workflows, superior pipeline and lead management, email and SMS messaging, a click-to-call VOIP softphone)

- Affordable monthly pricing

- Auto local presence dialing from all 50 US states

- Responsive and friendly customer service that doesn't rest until your query is solved

- An outstanding app for Android and iOS

- Free onboarding, CRM set-up, and ongoing training

And to leave no stone unturned and be completely objective, here's a link to our testimonials and reviews so you can see what our customers are writing about us online.

If you like what you read, then don't forget that we offer a two-week free trial with no strings attached - so go ahead and take our CRM for a test drive!

Monthly cost: $119 per month for unlimited users (as of January 2024)

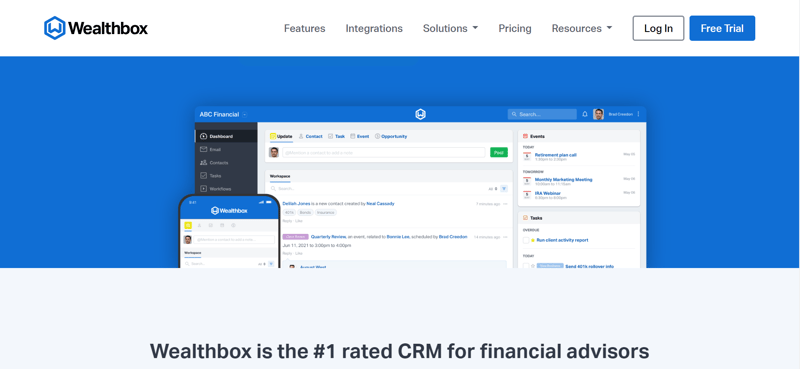

4. Wealthbox CRM

Wealthbox CRM is making waves in the financial services sector.

It's one of the fastest-growing solutions, and it has recently overtaken several competitors to become the second-largest CRM by market share in the financial services sector.

Not bad at all for a firm founded in 2014.

How has Wealthbox achieved such resounding results?

They've created a stellar solution that perfectly suits a previously underserved market segment: independent advisors and small finance companies.

Smaller firms can finally unlock the functionality of a higher-end CRM without the costs and the pain of setting one up.

All it takes is a simple onboarding process and a few quick guides, and then you can get started managing contacts, tasks, automation, projects, and pipelines.

Wealthbox's best features are its:

- Bank-level data security

- Click-to-call capabilities

- Integration with email platforms and financial tools

- Social media monitoring

The only two things holding it back are average customer service and slow system updates/patches. Of course, it's not the end of the world, but it's something to keep in mind before becoming a user.

Monthly cost: Their pricing starts at $45 per user per month, billed annually (as of January 2024)

5. Zoho Finance CRM

The last financial services CRM software to make our list is Zoho Finance CRM.

It's an adapted version of the extremely popular Zoho CRM, a solution that proudly counts over 150,000 businesses from 180 countries as its clients.

While not as powerful and well-established as the other financial planning CRMs to make our list, Zoho is still an excellent alternative for financial advisors looking to upgrade and automate how they manage their customer relationships.

It offers an intuitive user interface, a sophisticated AI assistant named Zia, solid financial account management, a billing and payment system, and even a way to gamify your sales process.

But the best thing about this CRM is that it's fully compatible with Zoho's nearly infinite suite of apps. This means you're never far away from whatever extra functionality you'd like to add to your tech stack.

Invoicing, accounting, surveys, digital signatures, appointments — they're all right there waiting for you to add them to your account in exchange for a small monthly fee.

What about the negatives?

- Their customer support isn't the best.

- It has a steeper learning curve than all the other CRMs on this list apart from Salesforce.

Monthly cost: Zoho's pricing starts at $12 per user per month, billed annually (as of January 2024)

Conclusion: Grow Your Business With Finance CRM Software

Unfortunately, it's time for us to say goodbye.

But before we go, we want to leave you with three parting thoughts.

First, here's a recap of the best CRM software for financial advisors.

|

CRM |

Main Benefits |

Ongoing Costs |

|

1. Redtail CRM |

|

Starts at $39 per user/month billed annually for up to 5 users |

|

2. Salesforce FSC |

|

$300 - $475 per user |

|

3. Ringy |

|

$119 per month for unlimited users |

|

4. Wealthbox CRM |

|

Starts at $45 per user per month, billed annually |

|

5. Zoho Finance CRM |

|

Starts at $12 per user per month, billed annually |

Second, we want to remind you that, despite all the benefits we've covered today, the true power of a CRM for financial advisors comes from your willingness to use it to cultivate enduring client relationships.

You can't expect an AI assistant to do all the work for you.

Your tech partner is simply there to take over repetitive, low-value tasks and provide you with the tools and time you need to earn your client's trust.

Third, we'd like to give you one last bit of advice:

Don't get lost in the myriad of CRM solutions and delay picking a new solution. Instead, take advantage of free trials (like ours) and get the ball rolling early!

It'll be worth it, as the earlier you start, the sooner you'll start seeing results.

And if you happen to encounter any doubt or struggle with anything on your journey, don't hesitate to reach out — we're always happy to help with CRM or sales-related questions.

Skyrocket your sales with the CRM that does it all.

Calling? Check. SMS? Check. Automation and AI? Check. Effortlessly keep in touch with your customers and boost your revenue without limits.

Take your sales to new heights with Ringy.

Sales in a slump? Ringy gives you the tools and flexibility you need to capture leads, engage with them, and turn them into customers.

Subscribe to Our Blog

Enter your email to get the latest updates sent straight to your inbox!

Categories

Related Articles