10 Best Ways to Generate Auto Insurance Leads

Updated on

Updated on

By Robins Dorvil

By Robins Dorvil

Robins Dorvil

With over 7 years of experience in the insurance industry, 4+ years as an Account Executive at Ringy CRM, and 17 years as a Creative Real Estate Inves...

learn more

Robins Dorvil

With over 7 years of experience in the insurance industry, 4+ years as an Account Executive at Ringy CRM, and 17 years as a Creative Real Estate Inves...

Table of Contents

Table of Contents

Are you an insurance agent looking to expand your customer base and boost sales?

Look no further!

This comprehensive article delves into auto insurance leads, the key to attracting potential clients and growing your organization. Whether you're a giant corporation or a small agency, understanding the potential of car insurance leads is crucial in today's competitive market.

Here's what you'll learn in this guide:

- What are auto insurance leads?

- Should insurance agents buy them?

- How to effectively close leads?

- The step-by-step process of closing leads

- Best strategies to find legitimate leads

- Software for generating free auto insurance leads

With these topics in mind, we aim to provide you with a wealth of information to help you successfully navigate the world of car insurance leads. From understanding the basics to mastering the art of conversion, this article will equip you with the knowledge and tools to take your insurance business to new heights.

Let's get started!

What Is an Auto Insurance Lead?

Auto insurance leads play a pivotal role in the world of insurance agents. They represent potential customers interested in purchasing an auto insurance policy. Auto insurance leads are obtained through multiple channels, including:

- Referrals

- Online forms

- Chatbots

- Purchased from auto insurance lead companies

Understanding the different types of auto insurance leads is essential for agents to make informed decisions and tailor their strategies accordingly.

Types of Auto Insurance Leads

Let’s take a look at the various categories of auto insurance leads:

|

Types of Auto Insurance Leads |

Description |

|

Exclusive leads |

These auto insurance leads are exclusive to a single agent, reducing competition among employees |

|

Shared leads |

Shared auto insurance leads are typically given to multiple agents simultaneously. |

|

Aged auto insurance leads |

These auto insurance leads may be non-exclusive or exclusive, generally 30 to 60 days old. |

|

Qualified leads |

Qualified leads are prospects who are generated by a marketing team, evaluated for eligibility by the sales team, and fit the company’s ideal customer profile (ICP) |

|

High-intent leads |

This is someone who is likely to purchase from your organization |

As you can imagine, each type of lead has advantages and disadvantages, so it is critical to personalize your approach appropriately. Knowing the options is vital to whether you prefer to go for exclusive leads like an actual insurance agent connoisseur or embrace the shared channeling methodology.

Should You Buy Auto Insurance Leads?

Several factors must be considered when deciding whether an agent or business should invest in auto insurance leads.

Let's explore critical points to assist you in making an informed choice:

- Targeted outreach: Auto insurance leads provide a target audience interested in insurance coverage. By buying leads, agents can focus their efforts on individuals actively seeking auto insurance, increasing the chance of a conversion.

- Efficiency and time: Generating leads organically is time-consuming. Buying auto insurance leads can save agents valuable time by offering a pool of potential customers ready for engagement. This allows agents to decimate their resources to build relationships and close deals rather than invest time in lead generation.

- Competition and Exclusivity: These auto insurance leads offer the advantage of reduced competition. When agents purchase exclusive leads, they gain a competitive edge by being the sole recipient of that lead, enhancing their chance of successfully converting them into customers.

- Quality considerations: It's essential to test the quality of auto insurance leads before purchasing. Reputable lead generation companies provide verified and qualified leads, ensuring that agents invest in prospects genuinely interested in buying an auto insurance policy.

- Cost-effectiveness: While purchasing auto insurance incurs costs, evaluating the potential return on investment is critical. Agents should consider the conversion rates of leads, their value in terms of policy premiums, and the overall impact on their business growth.

Buying auto insurance leads depends on each agency's specific needs and goals. Agents can determine whether purchasing leads align with their organization's strategy and growth objectives by meticulously observing the benefits, costs, and potential outcomes.

How to Evaluate Automobile Insurance Leads?

Assessing the suitability of a lead and its potential value to an agency is critical. Consider key factors, such as national premium averages for insurance types, commission, and conversion rates.

These figures assist in determining whether the profit generated from new policies and renewals outweighs the actual cost of each insurance lead. An analysis of this nature is vital to deciphering the feasibility of purchasing auto insurance leads for a specific circumstance.

Let's break it down further with a table that outlines the components to consider:

|

Factors to Consider |

Descriptions |

|

National premium averages |

Analyze the average premiums sold nationally for different insurance types for a benchmark to compare against your automobile insurance lead cost. |

|

Commission rates |

Evaluate the commission rate earned on policies sold; this impacts potential revenue from closing leads and deals. |

|

Conversion rates |

Assess your historical conversion rates, which indicate the percentage of auto insurance leads that successfully converted into policies. |

Ultimately, the goal is to ensure that the return on investment from each lead surpasses its actual cost. If the revenue generated from successfully closing an auto insurance lead exceeds the expenses incurred in acquiring it, that indicates a favorable outcome.

Evaluating the relationship between an auto insurance lead's cost and its potential profits gives you a clearer understanding of whether purchasing it is a viable and profitable strategy for your agency.

Tracking and analyzing these metrics is essential to adapt your lead acquisitions strategy and optimize overall business performance.

How to Validate Auto Insurance Leads

Validating an auto insurance lead is essential to ensure its authenticity and potential for conversion.

It would help if you meticulously verified the completeness and accuracy of the auto insurance lead's information.

To confirm the prospect's validity and active status, cross reference and organize contact details such as:

- Residential or post-address verification

- Email address

- Phone numbers

Inaccurate or incomplete information may indicate a lower-quality lead with minimal potential for conversion. An auto insurance lead obtained from a reputable source, such as a trusted lead generation company or organic inquiries from your website, are more likely to be reliable and of higher quality.

Conduct an initial contact with the auto insurance lead promptly after receiving their information. During this interaction, ask relevant questions to gauge the individual's interest and verify the authenticity of their insurance requirements.

Pay close attention to inconsistencies or discrepancies in the auto insurance lead's communication and information provided. If there are conflicting or incoherent details, this may raise concerns about the reliability of the lead.

Other factors to consider when validating leads include:

- Evaluate the leader's intent to purchase auto insurance

- Consider their budget and affordability

- Assess demographic alignment with the target market

- Research the lead's insurance history

- Track and analyze auto insurance lead performance throughout the sales pipeline

These validation steps can effectively assess the authenticity and potential of an auto insurance lead. Validating leads ensures your resources are concentrated on high-quality leads with a greater likelihood of conversion, enhancing the efficiency and success of lead generation efforts.

10 Ways to Find Legitimate Automobile Insurance Leads

As an insurance agent, the success of your business relies on a consistent flow of high-quality leads. In this section, we will explore ten effective strategies to help you discover legitimate leads that have the potential to convert into satisfied customers.

Partnerships

Forge strategic partnerships with businesses that synergize with the auto insurance industry. Collaborate with car rental agencies, vehicle leasing companies, and auto dealerships to establish referral programs and tap into their existing customer base.

This is a practical yet indirect way of generating auto insurance leads. For example, the auto repair shop recommends clients purchase your auto insurance policies, and you guide your customer to their service center.

Leads Through Referral Network

Leverage the power of word-of-mouth by building a solid referral network. Encourage satisfied clients, industry colleagues, and professionals in related fields to refer potential leads to your agency. Incentivize referrals through referral bonuses or discounts on premiums, creating a win-win situation for both parties.

Harnessing the power of referrals is a cost-effective and straightforward approach to acquiring auto insurance leads. You can unlock a wealth of potential prospects by tapping into your existing network.

Let’s look at a few ways to do that:

- Identify your target customer network

- Personalize outreach efforts

- Leverage satisfied customers

- Offer incentives

- Utilize social media platforms

- Provide exceptional customer service

Building a strong referral network takes time and effort. Consistently provide value to your customers, maintain strong relationships, and actively seek referrals. By implementing these strategies, you can utilize the power of referrals to obtain high-quality auto insurance leads and grow your business.

Events

In today's digital age, reaching potential customers goes beyond relying solely on social media or online advertisements. Many professionals have discovered that venturing out into the real world and engaging with people face-to-face yields fruitful results.

Consider dedicating a day every week or two to attending industry-related events. These could include expos featuring companies specializing in insurance products, association meetings hosted by ARDAN International, or conferences organized by the American Institute of Certified Public Accountants. These gatherings provide an excellent platform to showcase your products and services to a targeted audience.

By attending these events, you open yourself up to a multitude of opportunities to connect with individuals who are genuinely interested in the industry you operate in. Engage in meaningful conversations, share insights, and highlight the value of your offerings. Building personal connections and establishing rapport in person can leave a lasting impression on potential customers.

Create Inbound Lead Sources

Establish an effective inbound lead generation strategy to attract potential clients. Create informative and engaging content such as blog posts, videos, and guides that address common insurance concerns and educate prospects. Optimize your website for search engines and implement lead capture forms to extract visitor information and convert them into leads.

Influencer Campaigns

Collaborate with influencers and industry experts with a significant online presence and relevant audience. Get them to endorse your insurance services through sponsored content, guest blog posts, or social media shout-outs. This can increase brand visibility and credibility while attracting qualified leads from their followers.

Find Auto Insurance Leads From Agencies

Explore partnerships with other insurance agencies and brokers specializing in different coverage plans. Cross-referring leads that align with each other's expertise can expand your pool of potential customers and enhance the chances of closing deals.

Ads

Targeted offline and online advertising campaigns help organizations reach a wider audience. You can utilize radio spots, print media, PPC advertising, and social media platforms to promote your agency’s unique selling points and capture the attention of individuals actively seeking auto insurance policies.

Outbound Lead Generation

Take a proactive approach by implementing outbound lead-generation tactics. To reach potential leads directly, utilize telemarketing, email marketing, or email campaigns. Craft personalized messages highlighting the benefits of your insurance offerings and follow up with interested prospects to nurture the relationship.

Online Channels

Leverage the power of online channels to find legitimate automobile insurance leads. Utilize social media platforms, online forums, and professional networking sites to engage with potential clients. Participate in relevant discussions and provide valuable insights and reports while establishing yourself as a knowledgeable authority in the industry.

Leverage Data-Driven Marketing Strategies

One unique and highly effective way to find legitimate automobile insurance leads is by leveraging data-driven marketing strategies. By utilizing advanced data analytics, insurance agents can gain deep insights into customer behavior, preferences, and purchasing patterns.

How It Works:

- Data Collection: Gather data from multiple sources, including website analytics, CRM systems, social media platforms, and third-party data providers.

- Data Analysis: Use sophisticated tools and software to analyze the data, identifying trends, patterns, and potential leads for auto insurance.

- Targeted Campaigns: Develop targeted marketing campaigns based on the insights gained from the data analysis. This could include personalized email marketing, tailored social media ads, and customized content that addresses the specific needs and interests of potential leads.

Steps to Close Auto Insurance Leads for Agents

Closing an auto insurance lead requires more than just a sales pitch. It involves establishing a connection, understanding customer needs, providing relevant information, addressing objections, and ultimately guiding them toward making a confident decision with your agency.

Let's discover the steps that will empower you to close auto insurance leads and successfully achieve sales goals.

Establish Rapport

Begin by building a connection and establishing rapport with the lead. Listen actively, show empathy, and demonstrate a genuine interest in the prospect's insurance needs. Building trust and rapport sets a solid foundation for the closing process.

Understand Client Needs

Dive deeper into the lead's specific requirements and goals. Ask probing questions to uncover their coverage preferences, budget, and any concerns they may have. This understanding allows you to tailor your approach and offer personalized solutions.

Provide Clear and Comprehensive Information

Educate the lead about the various insurance options available to them. Clearly explain the coverage terms, benefits, and any additional services that may be relevant. Offer transparency and ensure they clearly understand the policy they are considering.

Address Objections

Anticipate and address any concerns or objections auto insurance leads may have. Be prepared to provide reassurances, clarify misconceptions, or offer alternative solutions. Effectively addressing complaints helps alleviate doubts and paves the way for a smoother closing process.

Communicate Value

Clearly articulate the value proposition of your insurance products or services. Highlight the advantages, such as comprehensive coverage, competitive pricing, flexible payment options, or additional perks like 24/7 customer support. Emphasize how your offerings provide peace of mind and protection.

Offer Competitive Quotes

Provide competitive insurance quotes tailored to the lead's requirements. Ensure the quotations are clear, accurate, and reflect the coverage discussed. Transparency in pricing builds trust and showcases the value customers receive for their investments.

Overcome Price Concerns

If price becomes a barrier, demonstrate the value of the coverage compared to the cost. Emphasize the long-term benefits and potential savings in the event of a claim. Offer payment options or discounts to make the coverage more affordable and appealing.

Call to Action

Conclude the conversation with a clear call to action. Guide the lead through the subsequent steps, whether completing an application, scheduling a follow-up meeting, or finalizing the policy online. Provide clear instructions and be readily available to assist with any additional inquiries or concerns.

7 Tips for Nurturing Auto Insurance Leads

Turning those initial auto insurance leads into happy customers requires effective nurturing. Here are 7 key strategies to cultivate strong relationships and convert leads into policyholders:

1. Respond to New Leads Promptly

When a potential customer submits their information for an auto insurance quote, respond promptly. Aim to reply within minutes or a few hours at most. This demonstrates responsiveness and keeps them engaged in the process.

2. Personalize Communication

A generic approach won't cut it. Take the time to personalize your communication with each lead. Address them by name, acknowledge their specific needs or questions, and tailor your message accordingly. This personalized touch fosters trust and positions you as a genuine advisor, not just a salesperson.

3. Educate and Inform Your Customers

People don't always understand the intricacies of auto insurance. Provide educational content that clarifies coverage options, deductibles, and other important factors. This empowers them to make informed decisions and builds confidence in your expertise.

4. Follow-Up Consistently

Don't leave leads hanging. Develop a follow-up strategy that includes regular check-ins via email, phone calls (if appropriate), or SMS. Address any lingering questions and offer additional support throughout the decision-making process. Consistent communication demonstrates your commitment to their needs.

5. Offer Competitive Quotes Quickly

Once you have a lead's information, obtain quotes from multiple reputable insurance companies. Present these quotes promptly in a clear and easy-to-understand format.

Highlighting competitive rates showcases the value you bring and strengthens your position as their insurance advocate.

6. Use Multi-Channel Marketing (SMS, Email)

People prefer to communicate in different ways. Utilize a multi-channel marketing approach that combines email marketing with SMS messages. This allows you to deliver targeted content, reminders, and quotes through their preferred channels for maximum engagement.

7. Utilize CRM Tools

Invest in a CRM tool like ours. Here’s why: A CRM helps you organize lead information, track interactions, and schedule follow-ups. This ensures consistent and personalized communication, ultimately leading to a smoother conversion process for auto insurance leads.

Best Software to Generate Exclusive Auto Insurance Leads for Agents

When generating exclusive auto insurance leads, agents can leverage various software solutions to streamline their lead-generation efforts and maximize their chances of acquiring high-quality leads.

Here are some of the best software options available.

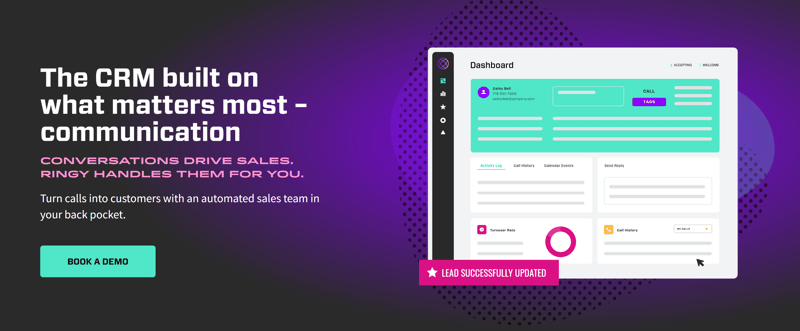

Ringy

At Ringy, we understand the importance of having a robust platform to drive your insurance business forward. With confidence in what Ringy offers, let us showcase the exceptional features that can transform your operations and improve customer relationship management tasks.

|

Feature |

Description |

|

Intuitive CRM |

User-friendly and visually appealing database for efficient lead and contact management. |

|

Local Call Capabilities |

Make local calls directly from the platform, eliminating the need for switching between tools. |

|

Marketing Automation |

Send personalized messages to target audiences, ensuring maximum engagement and conversion rates. |

|

Follow-Up Reminders and Automated Drip System |

Stay organized with follow-up reminders and engage leads through automated personalized drip campaigns. |

|

Granular User Access Control |

Grant specific access privileges based on user roles for enhanced data security and control. |

|

Mobile App |

Access and manage workflows on-the-go through the convenient mobile app. |

Simplify your workflow by seamlessly syncing Ringy with popular calendars like Google Calendar or integrating it with other emailing tools. This synchronization provides centralized access to your essential information, allowing you to efficiently manage your schedule, contacts, and communications from one place.

Ringy's exceptional capabilities will revolutionize your insurance business, providing the tools and functionalities needed to succeed in a competitive market.

InsureMine

This platform offers a comprehensive solution to manage the entire sales process, from insurance leads to policy renewals. InsureMine is designed to streamline your workflow and enhance customer relationships.

You can track agent activity seamlessly with custom pipelines and a cloud-based CRM. Set up automated follow-up systems, like event-triggered emails or SMS, to engage customers during important occasions.

Gain insights into your future insurance revenue with monthly sales forecasts and planning. InsureMine's exceptional customer care ensures clients receive assistance in understanding and maximizing the system's features.

Simplify your workflow, enhance customer relationships, and drive your insurance agency's success with InsuredMine.

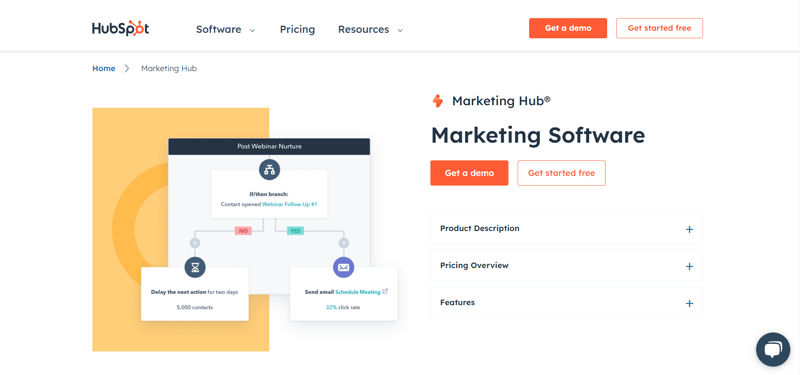

HubSpot

HubSpot offers a comprehensive social media management hub, allowing you to schedule date-specific posts easily. Manage your insurance leads efficiently by utilizing the lead management and tracking capabilities within a centralized database. Track and score multiple leads while accessing their conversation history.

Save time with ready-to-use email templates and gain insights into the effectiveness of your email campaigns through email tracking. Engage customers effectively with automated email DRIP campaigns, all without the need for additional plugins.

Assign tasks to teammates and monitor progress through a visual sales dashboard with KPIs. HubSpot keeps your customer conversations organized and accessible.

Streamline reporting by effortlessly filtering and generating reports across various departments within your insurance company. With HubSpot, managing your social media leads, emails, engagements, and tasks becomes seamless and efficient.

HyperLead

HyperLead focuses on delivering high-quality, exclusive leads through a multi-channel approach. Here are some key features that make it attractive for agents seeking exclusive auto insurance leads:

- Targeted Lead Generation: HyperLead allows you to define your ideal customer profile based on demographics, driving history, and desired coverage. This ensures the leads you receive are highly relevant and more likely to convert.

- Real-Time Lead Delivery: Receive exclusive leads in real-time as they become available. This allows you to be the first to connect with potential customers, increasing your chances of closing the deal.

- Performance Tracking: Monitor the effectiveness of your lead generation campaigns with detailed analytics. This allows you to optimize your strategy and maximize your return on investment (ROI) for auto insurance leads.

LeadGenius

LeadGenius utilizes a data-driven approach to identify and connect you with qualified leads. Here are some features that cater to agents seeking exclusive auto insurance leads:

- AI-Powered Lead Scoring: LeadGenius employs artificial intelligence (AI) to score leads based on their likelihood to convert. This prioritizes your outreach efforts towards the most promising leads for auto insurance.

- Multi-Channel Communication Tools: Engage with leads through various channels like email, phone, or text messaging directly within the LeadGenius platform. This streamlines communication and allows for a personalized approach.

- Automated Workflows: Automate repetitive tasks like sending follow-up emails or scheduling appointments. This frees up your time to focus on nurturing leads and closing deals for auto insurance.

- Exclusive Lead Distribution: LeadGenius ensures you receive exclusive leads that haven't been distributed to other agents. This eliminates competition and increases your chances of securing the customer.

Auto Insurance Leads - Final Thoughts

Auto insurance leads play a vital role in the success of insurance agencies. They offer a valuable opportunity to expand your customer base and increase revenue. Insurance agents can drive growth and profitability by effectively evaluating, validating, and closing these leads.

However, finding legitimate leads can be a challenge.

That's where Ringy comes in.

With its intuitive CRM, automated follow-up systems, affordable pricing, and comprehensive lead management features, Ringy is the perfect all-in-one solution for insurance agencies. Take advantage of the opportunity to streamline your lead generation process and maximize results.

Request a demo to find out more!

Skyrocket your sales with the CRM that does it all.

Calling? Check. SMS? Check. Automation and AI? Check. Effortlessly keep in touch with your customers and boost your revenue without limits.

Take your sales to new heights with Ringy.

Sales in a slump? Ringy gives you the tools and flexibility you need to capture leads, engage with them, and turn them into customers.

Subscribe to Our Blog

Enter your email to get the latest updates sent straight to your inbox!

Categories

Related Articles