10 Tried and True Insurance Lead Generation Ideas

Updated on

Updated on

By Bradley Kovacs

By Bradley Kovacs

Bradley Kovacs

Bradley has been passionate about technology since childhood, starting with Microsoft Flight Simulator at age six. In college, he automated his data e...

learn more

Bradley Kovacs

Bradley has been passionate about technology since childhood, starting with Microsoft Flight Simulator at age six. In college, he automated his data e...

Table of Contents

Table of Contents

Insurance lead generation is simple, right?

Insurance protects you. It protects your business, family, car, and even your dog.

Common sense would tell us insurance can sell itself.

Well, things might be a bit more complicated than that.

Many challenges are standing in the way of an easy sell. Indecisive buyers, people completely unaware of your business, competing insurance agencies.

And considering 2.86 million people are employed by insurance companies in the US alone, that's a lot of competition.

After all, you might need some hot insurance lead generation tips to keep up. You know, tried-and-tested methods you can combine with one of the best lead generation programs.

So, insurance lead generation ideas and insurance lead generation software? You could say this blog has you covered.

What is Lead Generation for Insurance Agents

Lead generation in insurance describes the practice of identifying or gathering potential customers, usually through increasing interest and knowledge of your business. This increased interest then brings in new leads.

But what's a lead?

An insurance lead is an individual or company that has a want or need for your service, making them a potential prospect. They could have visited your website, received your business card, or simply Googled "best insurance."

Lead generation for insurance agents is essential because leads are the people you're targeting with your service.

You can be the best agent out there, and without leads, there's absolutely no point.

So you need a way to bring in leads. And not just any leads - the right leads for your business. This usually involves qualifying and scoring leads with a lead information system.

Leads can come from a variety of sources:

|

Type |

Description |

Inbound or outbound |

|

Real-time leads |

Leads who come to you, usually through contact forms |

Inbound |

|

Live transfer leads |

Leads transferred from a call center rep to a call buyer |

Inbound and outbound |

|

Search leads |

Leads obtained from internet searches, like Google ads and SEO |

Inbound |

|

Exclusive leads |

Leads sold exclusively to you |

Outbound |

|

Shared leads |

Leads sent to multiple agents |

Outbound |

This means that a myriad of insurance lead generation ideas exist. Lead vendors, marketing, and contact forms.

But let's not overwhelm you. We'll get to that in a minute.

Types of Insurance Lead Generation

Before we get to the juicy tips, let's quickly go over different types of lead generation in insurance.

Commercial insurance lead generation

You might also know commercial insurance by its other name - business insurance.

Traditionally (back in the old days), commercial insurance lead generation would entail networking, compiling lists of potential dream companies, sending snail mail, cold calling, and asking for referrals.

Some of those still work if used correctly by insurance agents. Still, nowadays, we use lead gen tactics like:

- A website with excellent SEO, contact forms, and lead magnets

- LinkedIn and social selling

- Webinars and podcasts

- A stellar drip campaign

Commercial insurance lead generation can be tricky because not every business has an immediate need for coverage - or they have another provider.

We have to keep up with the latest commercial insurance lead generation ideas to stay ahead of the game.

Home insurance lead generation

Home insurance is insurance covering your private property - which means that as the economy grows and more people start to become homeowners, the more demand there is for significant home insurance.

Many of those people are first-time homeowners, and the rest are most likely long-time homeowners looking to switch providers.

What does this mean? All your leads are neck-deep in question marks and red tape because being a homeowner isn't a walk in the park.

So one of the most effective tactics for home insurance lead generation is transparency.

Insurance companies that lay out their information, such as policy details, pricing, what they cover (and what they don't), deductibles, and add-ons, entice a lead simply because the lead now knows what they're looking at.

Taking one more question off their minds alleviates a lot of pressure.

Life insurance lead generation

The promise that your family will be taken care of in the event of a tragedy is a reassurance that millions of people are grateful for. 267 million people have a life insurance policy in the US.

Everybody is concerned for their family, and everybody would benefit from life insurance. Unfortunately, that doesn't mean that leads come streaming in without any work from you.

Some of the best life insurance lead generation ideas include attracting people to a transitional period in their lives.

They could be just starting a new job after getting out of college, adding a spouse into their lives, or welcoming some new little dependents into their homes.

Adorable little dependents.

This marks a massive moment in the person's life, so they'll be thinking of getting coverage, switching policies, or switching providers.

10 Insurance Lead Generation Ideas

We told you we'd get to the good stuff!

We've gathered 10 of the biggest, most effective insurance lead generation ideas so you can stay on top of the trends and keep those leads flowing in.

And before we start - lead vendors are an excellent way to bring in leads. But since that's big enough to be its topic, we won't be including them in this article.

Lead generation software

Lead generation software for insurance agents can help you attract high-quality leads that suit your business to a T. It can help organize those leads, move them through your sales funnel, and close more deals.

It helps automate the lead generation process to streamline your operations by generating call lists, tracking your interactions, managing your email marketing, monitoring your social posts and ads, etc.

But there's a reason why lead generation software is the first idea on this list - the solution is so useful that it streamlines most other thoughts on this list.

Web forms, newsletters, and other lead magnets

It's right in the name, isn't it? Lead magnet.

Creating killer lead magnets is a surefire way to boost your online insurance lead generation. 50% of marketers who start using lead magnets report higher conversion rates.

Lead magnets are essentially enticing services, freebies, or information that are offered in exchange for the lead's contact information, making them a prospect.

Lead magnets take many different forms:

- Newsletters

- Forms

- Whitepapers and guides

- Reports and case studies

- Special offers and contests

- Live chats and chatbots

You're offering something valuable in exchange for email addresses and phone numbers. It's simple, but it works.

Email marketing

Did a lead fill out a form, enter a contest, or subscribe to a newsletter?

Congrats! Now it's time for email marketing to shine.

Email marketing will help you connect with your target audience and understand their pain points and concerns. This, in turn, will build trust and close more deals.

In fact, the ROI for email marketing stands at $42 for every $1 spent.

A few practices to ensure successful email marketing:

- Attention-grabbing subject lines

- Campaign automation

- Loading each email with valuable, educational content

- Provide a relevant, clear call-to-action in the body of the email

And don't forget to A/B test your marketing emails - which is just monitoring open rates, click-through rates, and response rates.

SEO-optimization

Since SEO (search engine optimization) is how most of your audience will find out about your website, your company, and your services, you can see why it's one of the most important parts of insurance lead generation.

The brick-and-mortar world has billboards and newspaper ads. The internet world has SEO.

So the better your SEO, the better your online presence. And with a better online presence, you get a better lead generation.

Make sense?

Cool. Then let's go over some ways to improve your SEO:

|

SEO tactic |

Benefits |

|

Update existing content |

|

|

Analyze your competitor's performance |

|

|

Optimize page speed, and loading time |

|

|

Perform keyword research |

|

|

Create a content strategy |

|

Combining most (or all!) of these strategies will make it much more likely that when a lead Googles a phrase that you want to rank for - say something like "home insurance in pittsburgh" - you'll be at the top of the list.

Proudly strut your stuff on review sites

"Read a review before you buy it!"

That can't just be our dad's advice, right?

Leads are very likely to be found trawling review sites searching for the perfect insurance agency, so having a positive reputation on those sites will work in your favor.

Claim your listings on review websites so you can lay out information, use your brand voice, and ensure that unhappy customers don't fill it out for you. You can then direct happy customers to the site to leave you a review.

Because unfortunately, unsatisfied customers tell way more people about their experiences than satisfied ones.

Create a referral program

One of the best ways to bring in new customers is to have current, satisfied customers spread the word.

Creating a referral program is outstanding for insurance lead generation. It gives customers a solid reason to tell their friends and family about how great your company is. You can try offering incentives like:

- Movie tickets

- Coupons

- Discounts

- Donations

That's because few people listen to: "Tell your friends about us!" without getting something in return.

Social selling

Social selling is the act of interacting with leads on social media to spread awareness and build rapport.

Most commonly this is done through LinkedIn, but other social media outlets work great, too. Like Twitter, Facebook - even Instagram.

Insurance on Instagram?

Seems unbelievable? Check out Geico's Instagram account:

Geico regularly posts funny pictures and reels, which establishes them as usual and relatable and connects them to thousands of potential customers.

And there have to be at least a few good leads among their 46,000 followers, right? 🤩

Regular sales funnel management

Yeah. This one is boring after all that neat social selling stuff, huh?

But regular funnel management is imperative for lead generation.

Your sales funnel could have detrimental cracks causing fantastic leads to slip out.

Monitoring your processes, looking for crucial drop-off points, and ensuring your funnel is a smooth, gradual slope - all have the potential to improve the way your agency brings in leads.

Detailed CRM analytics will help you pinpoint issues in your sales funnel and keep everything running smoothly.

A CTA on every page

Does your website have a call-to-action (CTA) that leads to a contact form or a lead magnet? Yes. Every page.

No, it's not excessive. It's helpful. If you have a customer researching insurance plans, you don't want them to have to search for the "Contact us" or "Request a quote" buttons.

If they're looking at your website and thinking yours could be the perfect plan, you want a clear CTA leading them to you.

Otherwise, they may go searching elsewhere.

Provide amazing educational content

Teaching people is an excellent way to engage them - especially in a somewhat confusing industry like insurance.

Providing educational content will entice and inform. Webinars and podcasts are genuine, value-driven resources that act as ads for your services.

51% of B2B buyers are willing to share information about themselves or their company to register for webinars, making webinars the most attractive lead magnet out there.

Important note: Don't jump right into the sale. Educate, provide value, and your service will sell itself.

You can also guest star on other podcasts and webinars if you aren't ready to host your own.

Tips for Boosting Insurance Lead Generation Online

You understand what insurance lead generation is all about and some of the best ideas to implement. Now you need to know how you can scale those ideas and boost lead generation online.

And here's how you can do it.

Seek Leads from Third-Party Companies

Many companies specialize in insurance lead generation. They gather potential customer information through various channels and sell these leads to interested insurance agents or agencies. Life insurance lead generation and commercial insurance lead generation are just a few of the specific niches these services can target.

Lead costs can vary depending on factors like the type of insurance (life insurance leads tend to be more expensive than auto insurance leads), the quality of the leads (highly targeted leads will cost more), and the lead provider itself. Calculating cost per lead is important to ensure you're getting a good return on your investment. This involves dividing your total spend on leads by the number of leads generated.

Find Prospects on Social Media

Social media platforms offer a goldmine of potential customers. By creating engaging content and running targeted ads on platforms like LinkedIn, Facebook, and Twitter, you can connect with people who are actively searching for insurance information or might be receptive to your offerings.

Network with Other Professionals

Building relationships with professionals in complementary fields can be a powerful lead-generation strategy. Partnering with real estate agents, mortgage brokers, or financial advisors can open doors to new clients who might need insurance products in addition to these professionals' services.

Why Do Insurance Agents Buy Leads?

While organic lead generation strategies are important, purchasing leads can offer several advantages:

- Faster Growth: Buying leads provides a shortcut to reaching potential customers who have already expressed interest in insurance products. This can be particularly beneficial for new agents who are still building their client base.

- Targeted Leads: Many lead generation companies allow agents to specify criteria for the leads they purchase. This ensures they're reaching individuals who are a good fit for the types of insurance they offer, increasing the chance of converting leads into sales.

- More Efficient Use of Time: Prospecting and nurturing leads can be time-consuming. By purchasing pre-qualified leads, agents can free up valuable time to focus on building relationships with potential clients and closing deals.

- Predictable Lead Flow: Buying leads creates a predictable influx of potential customers, allowing agents to more effectively plan their sales activities and outreach strategies.

Best Insurance Lead Generation Software

Remember our very first lead generation idea? We're not just going to tell you:

"Lead generation software for insurance agents sure is great!"

And then leave you hanging. That's not how we do things.

So, without ado, here are our top 5 insurance lead generation software choices:

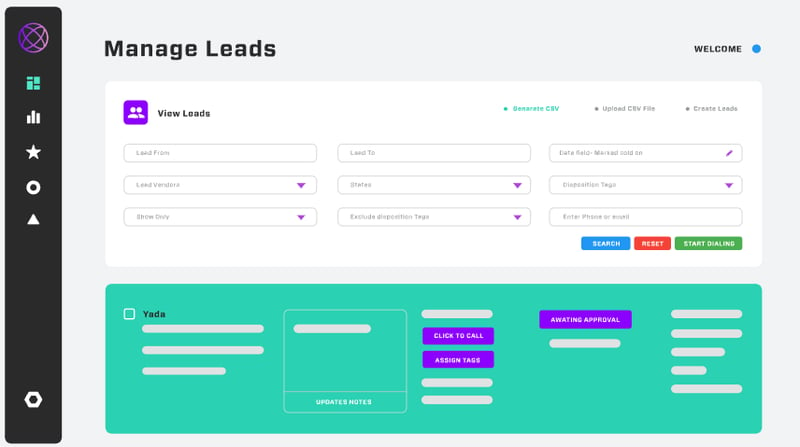

1. Ringy

Don't give us that look. We aren't showcasing our software for no reason!

When it comes to insurance lead generation services, Ringy is a top contender. Check out some of our extensive lead management and lead generation features:

- Import leads - from your lead vendor, spreadsheets, or manually

- Full lead visibility - know where your leads are and where they came from

- Email and SMS tracking - know the second a lead responds

- Add notes and scheduling to leads - get notifications on your dashboard for upcoming tasks

- Custom lead labeling - personalize your leads with labels like "hot," "cold," and "maaaaaybe"

You can see why insurance companies love Ringy:

Plus, Ringy's so much more than just lead generation. As an all-in-one insurance CRM, Ringy also features analytics, reporting, task automation, and VoIP softphone and texting.

Pro tip: it's easy to create VoIP text campaigns for even more lead generation!

And we also offer a nifty mobile app, so you have your data with you wherever you are.

Ringy is an affordable CRM solution at just $119 / month.

2. EngageBay

EngageBay is a well-known name in the lead generation software game. It advertises itself as an all-in-one marketing platform and CRM and has a free version for start-ups and small businesses.

Main lead generation features include:

- Email marketing

- Landing pages

- Web forms

- SMS marketing

- Contact management

EngageBay includes excellent data and analytics to monitor what works and what doesn't. You can get a clear picture of your business and your leads and make better decisions.

It's also a CRM, which means you also get reporting, scheduling, and essential business efficiency tools. Features aren't as detailed as Ringy's, but that's to be expected from a CRM aimed at start-ups.

Pricing starts with a free package, but it goes up to $119.99 per user/month (pricing accurate as of 03/2024).

3. Freshsales

Freshsales (formerly Freshworks) is a CRM solution that's highly rated for its lead generation. It includes lead scoring, lead management, and email marketing features.

We like the ability to monitor audience interactions. Monitoring website activities, email activities, and keeping general visibility into your brand helps you A/B test your lead generation practices.

Freshsales also allows you to automate tasks, stay organized with a detailed calendar and scheduling, and qualify your leads based on their profile and overall engagement.

They offer a 21-day free trial, although the most popular pricing package is $47 per user/month. For additional fees, you can add a handful of bonus add-ons to your chosen package (pricing accurate as of 03/2024).

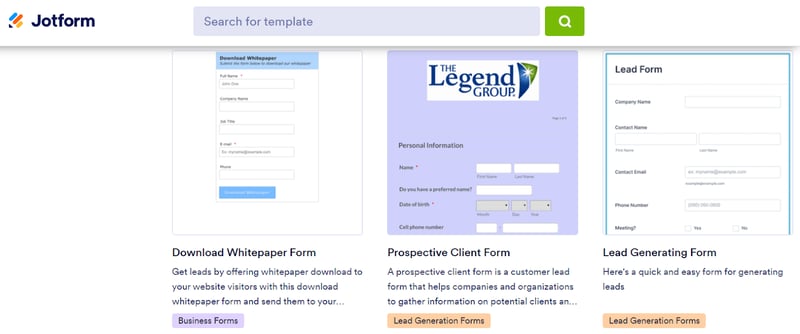

4. JotForm

JotForm is professional form software that enables you to create customized forms to generate more leads and collect data.

They allow you to detail your forms with your logo, fonts, and colors.

JotForm even has a category just for lead generation forms that contains over 100 templates, with options like customer registration, client questionnaire, prospective client, and even a download whitepaper form.

So you can use it to help distribute those invaluable lead magnets we mentioned.

And JotForm integrates with over 150 different applications so your forms can send your prospects' messages to project management boards, CRMs, cloud storage apps, and more. JotForm integrates with Zapier, and Zapier integrates with Ringy.

So why not grab JotForm and Ringy and use them together?

Pricing starts with a free package, but the best value is the $49 / month package (pricing accurate as of 03/2024).

5. Keap

Keap (formerly known as Infusionsoft) is an insurance CRM and marketing platform aimed at helping you capture more leads, nurture them into prospects, and foster healthy relationships.

Notable lead generation features include forms, easy appointment scheduling, landing pages, and lead magnet templates.

And with Keap's analytics and reporting, you can monitor lead progression as customer information updates in real-time.

Including CRM features, Keap is an excellent choice for entrepreneurs and start-ups who want to manage their businesses better, optimize their customer experiences, and generate some leads while doing so.

Pricing starts at $199 / month (pricing accurate as of 03/2024).

A Wealth of Insurance Lead Generation Ideas

We hope we've sufficiently armed you with knowledge, tips, and tricks for lead generation for insurance agents.

Work on your SEO, build a whitepaper or ebook, create a referral program, guest star on a webinar, and don't forget the insurance lead generation software.

Whether you're looking for advice on home, life, or commercial insurance lead generation, these ideas will help you out. Guaranteed.

Not entirely through researching leads? We don't blame you. Why not keep reading on the topic with our blog posts on how to generate leads and lead automation?

Or you can contact Ringy and request a demo to take the next step in your lead generation capabilities today!

Skyrocket your sales with the CRM that does it all.

Calling? Check. SMS? Check. Automation and AI? Check. Effortlessly keep in touch with your customers and boost your revenue without limits.

Take your sales to new heights with Ringy.

Sales in a slump? Ringy gives you the tools and flexibility you need to capture leads, engage with them, and turn them into customers.

Subscribe to Our Blog

Enter your email to get the latest updates sent straight to your inbox!

Categories

Related Articles