Finding the Best Life Insurance Leads [Tips & Recommendations]

Updated on

Updated on

By Robins Dorvil

By Robins Dorvil

Robins Dorvil

With over 7 years of experience in the insurance industry, 4+ years as an Account Executive at Ringy CRM, and 17 years as a Creative Real Estate Inves...

learn more

Robins Dorvil

With over 7 years of experience in the insurance industry, 4+ years as an Account Executive at Ringy CRM, and 17 years as a Creative Real Estate Inves...

Table of Contents

Table of Contents

Generating the best life insurance leads is a fundamental aspect of the success of your organization.

In this comprehensive guide, we will explore how to generate the best life insurance leads, including company-provided leads, third-party leads, social media strategies, and networking with other professionals. We'll also recommend the top life insurance leads programs and emphasize the importance of using a CRM (Customer Relationship Management) system to organize your leads effectively.

So, grab your capes and prepare to learn how to get the best life insurance leads before your next board meeting!

Best Ways to Generate Life Insurance Leads

In this high-stakes game, discovering the best life insurance leads is like finding hidden treasure. This section delves into some of the most effective methods for acquiring leads that can make a significant impact on your insurance career.

Company Life Insurance Leads

One of the most straightforward ways to ensure a steady stream of the best life insurance leads as an agent is to join a company that supplies its representatives with leads.

Many life insurance agencies attract potential agents with the promise of leads during the recruitment process. While the idea of not having to hunt for leads independently is enticing, the reality often falls short of the picture painted by these organizations.

Working for a company that offers sales leads can provide several advantages:

- Risk-Free Leads: When an enterprise provides leads, you don't have to invest your own money in leads that may not result in sales. Typically, these companies offer leads without upfront charges.

- Time Efficiency: You can focus on what generates income—contacting prospects and selling life insurance—rather than comparing lead providers and their costs.

- Support and Assistance: Since the business invests in these leads, they are vested in your success. Therefore, they are more likely to offer support and assistance in overcoming sales challenges.

It's essential to understand that company-provided leads are only partially free. The trade-off often involves a reduction in your commissions.

Moreover, these leads have a reputation for being "well-worn." The high turnover rate in many of the best life insurance agencies means that leads frequently change hands. When an agent departs, the organization reclaims and redistributes its leads.

By the time you receive a company lead, it may have already been contacted by several previous agents. It's crucial to weigh the benefits and drawbacks to determine if this approach aligns with your sales software strategy and skills.

Third-Party Leads

If your company doesn't offer leads or if you're dissatisfied with their quality, third-party lead providers are a viable alternative. These organizations specialize in selling the best life insurance leads to agents.

The process is straightforward: you specify your geographic preferences and the number of leads you want, then pay upfront. In return, you receive leads within your chosen area.

One significant advantage of using third-party leads is that they typically cost less in terms of commissions compared to company-provided leads. This mainly benefits experienced salespeople with a high closing rate, as the lead cost represents a smaller fraction of their earned commissions.

Some third-party lead providers offer the choice between exclusive leads (sold only to you) and non-exclusive leads (shared with other agents). Exclusive leads, while more expensive, result in less competition for potential clients.

However, a notable drawback of third-party leads is the financial risk associated with paying upfront for them. If you fail to convert any of the leads, it can lead to a negative financial outcome, making this option more suitable for experienced agents. New agents still honing their sales skills may find this financial risk challenging.

Utilizing Social Media

Social media is an excellent tool for finding the best life insurance leads.

To successfully attract new customers on LinkedIn, it's essential to tap into the platform's full potential. Your profile is your digital first impression, so making it stand out is vital.

Here's a table highlighting the key steps to optimizing your LinkedIn profile.

|

Key Steps to Optimize Your LinkedIn Profile |

Description |

|

Robust Profile |

Your profile picture should project professionalism. A professional headshot is a must. |

|

Detailed Job History |

Your job history section should resemble a resume with accomplishments highlighted in a conversational tone. |

|

Thoughtful Summary |

Craft a detailed summary highlighting your professional background, why you chose life insurance sales, and your achievements in the field. |

A comprehensive LinkedIn profile is your gateway to connect with potential clients. By taking these steps, you'll present yourself as both a professional and a person, making your profile more enticing to visitors. Remember, LinkedIn is not just a virtual resume; it's a platform for meaningful professional connections.

Networking With Other Professionals

One of the most effective strategies for securing life insurance leads without resorting to cold calling, depending on overstretched company leads, or dipping into your own funds is networking with fellow professionals.

In many urban centers, you'll find local networking groups where professionals from diverse fields convene weekly or monthly. Here, they share insights, exchange marketing strategies, and refer clients to one another. These meetings provide an excellent opportunity to build a network to help you tap into a steady stream of the best leads for insurance agents, making your insurance lead-generation efforts more efficient and less reliant on traditional approaches.

Best Life Insurance Leads Program Recommendations

In life insurance, securing high-quality leads is paramount for success. Here, we present three best life insurance leads programs that can be your guiding stars in the vast expanses of client acquisition.

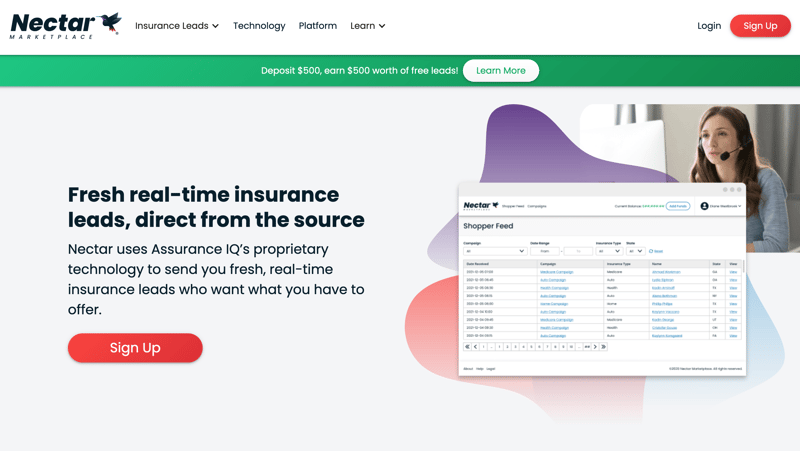

Nectar Marketplace

Nectar Marketplace is a reputable platform renowned for delivering top-tier life insurance leads. The company's leads are often pre-qualified, streamlining the conversion process for agents. With a diverse array of lead options, Nectar Marketplace stands as the best source for life insurance leads for agents in search of the finest quality lead contact details.

Everquote

Everquote, a seasoned player in the lead generation marketplace, specializes in providing insurance leads, including life insurance. Their leads are celebrated for their precision and can be a robust choice for agents aiming to broaden their client base.

QuoteWizard

QuoteWizard offers a versatile platform connecting insurance agents with individuals actively seeking insurance quotes. Their offering encompasses various lead types, including valuable life insurance leads, making it an adaptable choice for agents navigating the intricate landscape of client acquisition.

Why Using a CRM to Organize Life Insurance Leads Is Important

In the ever-evolving insurance landscape, staying ahead of the curve is vital for success. One powerful tool that can elevate your insurance agency to new heights is a robust CRM insurance software, such as Ringy. Our technology offers a multitude of benefits that can drive your agency's growth and efficiency.

Here are nine key benefits of implementing an insurance CRM:

- Automate Sales Workflows: Streamline and automate your sales processes, improving efficiency and reducing manual tasks.

- Track Commissions: Easily monitor commissions for your agents, ensuring accuracy and transparency.

- Enhance Marketing Efforts: Improve and simplify your marketing initiatives, resulting in more effective campaigns.

- Automate Lead Allocation: Efficiently allocate leads and uncover upselling and cross-selling opportunities, maximizing revenue potential.

- Track Insurance Policies and Claims: Keep a close eye on insurance policies and claims, providing better customer service and managing risks effectively.

- Client Portal: Offer a Client Portal for customers to self-service their policies, saving your company resources and enhancing the customer experience.

- Customization: Augment your insurance broker software and CRM platform to meet your unique needs, ensuring it aligns perfectly with your business.

- Scalability: Use the CRM system to scale your business and handle growth seamlessly.

- Personalization: Deliver personalized experiences to your customers and clients, enhancing relationships and satisfaction.

- Agent Onboarding: Onboard new agents quickly and effectively, ensuring they are ready to contribute to your agency's success.

Implementing a robust CRM system is more than just a technological upgrade; it's a strategic decision that can revolutionize your insurance agency. By embracing the benefits of an insurance CRM platform, you position your agency to thrive in a competitive industry and provide top-notch service to your clients and customers.

Get the Best Life Insurance Leads Today!

Whether you rely on company-provided leads, third-party providers, social media strategies, or networking with professionals, the path to success is as diverse as the clients you aim to serve.

For those eager to elevate their insurance agency, consider Ringy your ultimate solution. With VoIP calling capabilities, sophisticated customer segmentation tools, and seamless AI integration, Ringy is the best way to generate life insurance leads. It's not just a call to action; it's a call to transformation. Let us be your growth partner, helping you build a robust sales pipeline and provide top-tier service to your clients.

Request a demo to find out how our software can transform your organization.

Skyrocket your sales with the CRM that does it all.

Calling? Check. SMS? Check. Automation and AI? Check. Effortlessly keep in touch with your customers and boost your revenue without limits.

Take your sales to new heights with Ringy.

Sales in a slump? Ringy gives you the tools and flexibility you need to capture leads, engage with them, and turn them into customers.

Subscribe to Our Blog

Enter your email to get the latest updates sent straight to your inbox!

Categories

Related Articles