All You Need to Know About Cross Selling Insurance

Updated on

Updated on

By Carlos Correa

By Carlos Correa

Carlos Correa

Carlos has been involved in the sales space for well over ten years. He began in the insurance space as an individual sales agent, managing teams as s...

learn more

Carlos Correa

Carlos has been involved in the sales space for well over ten years. He began in the insurance space as an individual sales agent, managing teams as s...

Table of Contents

Table of Contents

Have you ever been to a fancy restaurant where the waiter asks if you want to try their "specialty cocktail," and before you know it, you've ended up with a fancy drink, a fancy dessert, and a fancy bill? Well, that, my friend, is the magic of cross-selling.

Similar to how the waiter persuaded you to sample multiple dishes on the menu, your insurance company can employ the same approach to encourage your clients to purchase multiple insurance policies.

As an insurance agent, you've already sold your client a policy for their car or home. But other insurance options are waiting to be paired with their existing coverage. With the right approach, cross-selling can be a win-win for you and your client.

So, let's dig into cross-selling insurance and explore how it can benefit your business.

What is Insurance Cross Selling?

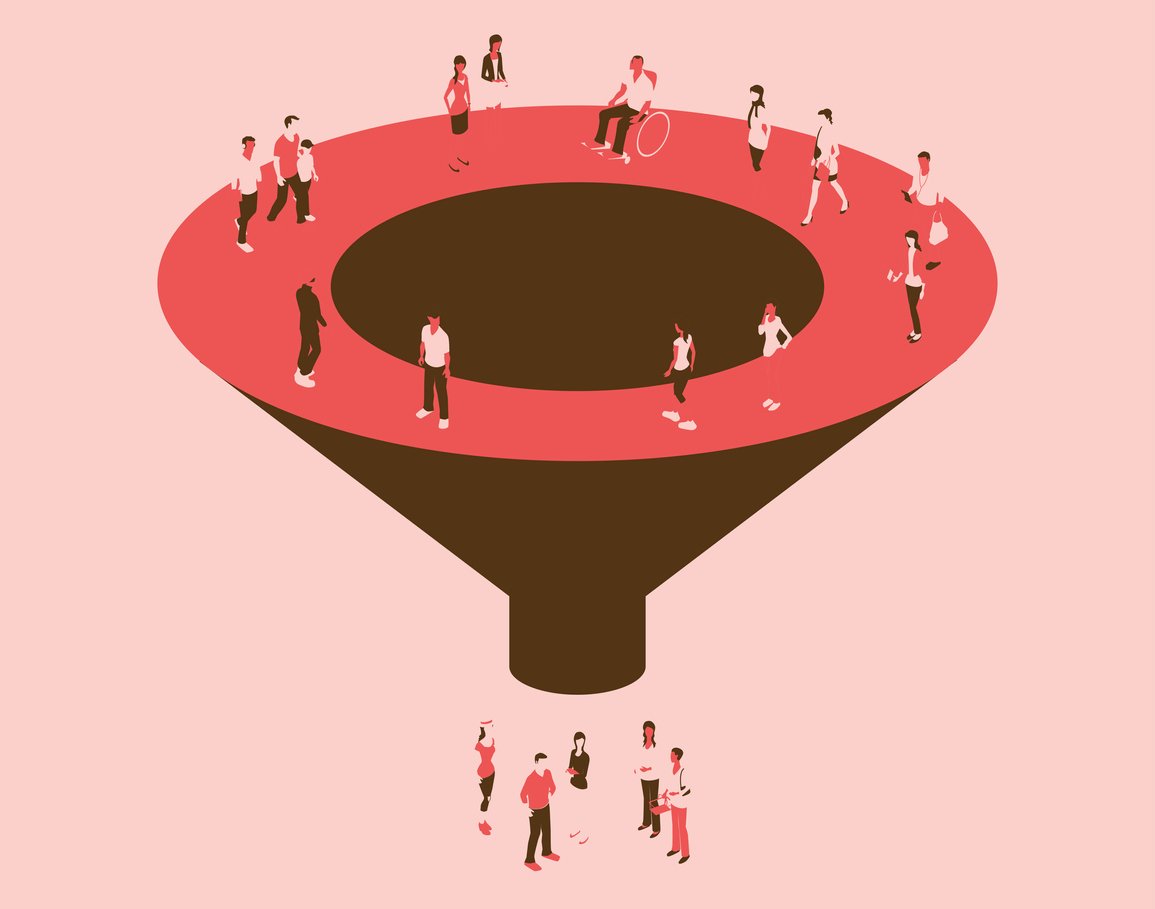

Cross-selling in insurance refers to offering additional insurance products to an existing policyholder. It is an effective strategy for insurance companies to increase their revenue while providing customers with a comprehensive insurance portfolio.

Cross-selling opportunities arise when customers show interest in other insurance products, such as auto or life insurance, or claim they may benefit from additional coverage.

An insurance company selling homeowners insurance may provide a discounted rate for auto insurance to a policyholder who has recently bought a new car. Likewise, they may offer life insurance coverage to a customer who has just had a baby to safeguard the child's financial security in the case of an unexpected demise.

Why Is Cross Selling Important for Insurance?

There are several benefits of cross selling insurance, making it an attractive option for insurance companies. Some of the main reasons you should consider cross-selling are:

1. Increased Revenue

There are a few ways cross-selling techniques can help increase revenue for your insurance firm, but some of the most common ones include the following:

- Increasing the average revenue per customer. Instead of relying solely on the premiums from a single policy, insurance companies can offer additional policies to the same customer. By doing so, the company increases its revenue from that customer.

- Reducing customer churn. Customers with multiple insurance company policies are less likely to switch to another company. Hence, insurance companies can reduce customer turnover by increasing loyalty and retention by offering additional policies.

- Expand the customer base. An insurance company may offer a discount on a life insurance policy to customers who already have a home or auto policy with them. By doing this, the company can reach potential customers interested in life insurance but haven't thought about choosing the company yet.

2. Increases Customer Loyalty

Because cross-selling involves multiple policies, customers are more likely to remember your company and develop a relationship with you. This can lead to increased loyalty—which means the customer is more likely to renew their policies with you when they come due for renewal. Here are some ways cross-selling can increase customer loyalty for insurance companies:

|

Methods |

Description |

|

Improved Customer Satisfaction |

Cross-selling can help insurance companies offer customized and tailored solutions to meet the evolving needs of their customers. Cross-selling and category-penetration techniques can result in a 20% increase in sales and a 30% increase in profits. |

|

Greater Customer Retention |

Cross-selling also allows you to build and maintain relationships with existing customers. When customers feel recognized, appreciated, and taken care of, they are more likely to stay loyal to the company. |

|

Improved Customer Lifetime Value |

Insurance companies can boost their customer lifetime value (CLV) by cross-selling. CLV refers to the total revenue a customer is predicted to generate throughout their association with a business. With the right strategies, insurance companies can increase the CLV of their customers, which can have a positive impact on their business performance. |

3. Expand Market Share

What does it mean to have a large market share? It means more customers for your insurance business, increasing revenue and profits. By cross-selling, you can expand your customer base and increase your overall market share.

Through cross-selling, insurance companies can reach out to new potential customers who may not have sought out the company otherwise. This can increase market share and boost brand awareness.

Cross-selling also allows you to target niche markets that may be difficult to reach through traditional marketing strategies. By offering customized solutions tailored to specific customer needs, insurance companies can expand their market share in the insurance industry.

4. Cost-Effective Marketing

Marketing takes about 8% of an insurance company's operating cost. Cross-selling can help reduce this cost as it is a much more cost-effective way to reach customers than traditional marketing strategies such as TV and radio ads.

Cross-selling allows insurance companies to target existing customers who may already be familiar with the brand and its offerings. This cuts down on the cost of customer acquisition and allows the company to focus its marketing budget on other areas, such as product development or customer service initiatives.

Additionally, you can leverage this approach to encourage your customers to promote your products and services, even when they are not looking to purchase additional policies.

How to Look for Insurance Cross Selling Opportunities

So, you've determined that cross-selling is the right approach for your insurance business. Now it's time to start looking for opportunities to implement this strategy. At first, it may seem daunting, but there are a few simple steps you can take.

|

Steps |

Description |

|

Analyze your insurance portfolio |

Analyze your current insurance portfolio and identify the types of customers you have and the breadth of products that they purchase. This allows you to identify which products complement each other and opportunities for cross-selling. |

|

Conduct customer surveys |

Surveys with existing customers can provide valuable insights into their needs and preferences. This information can be used to identify potential cross-selling opportunities. |

|

Determine your cross selling goals |

Once you've identified potential opportunities, it's time to determine your goals and objectives.

Knowing your specific goals will help you create a successful cross-selling strategy. |

|

Develop your plan of action |

Once you've identified your goals, it's time to develop your action plan.

Answering these questions will help you create a comprehensive cross-selling strategy that will help you reach your goals. |

|

Train Your Sales Team |

Your sales team is on the front lines of cross-selling efforts. Training them to identify cross-selling opportunities and present additional products to customers in a helpful and not pushy way is important. You can improve your cross-selling results by providing your sales team with the necessary tools and training. |

Benefits of Cross Selling Insurance

Cross selling insurance policies can bring numerous benefits to insurance companies and customers. Here are five reasons why cross selling insurance is a smart move.

1. Higher Revenue

Customers who bundle policies are more likely to stay with the same insurance company longer. This means more consistent revenue for the insurance company.

Not only do customers with multiple policies stay for longer, but they also tend to purchase more coverage overall. This leads to increased revenue for insurance companies.

2. Better Risk Management

Cross selling gives insurance companies a better overall view of the risks associated with each customer. For example, if a customer has a home insurance policy and purchases auto insurance, the insurance company can more accurately assess the overall risk associated with that customer.

This can lead to better underwriting decisions and more appropriate pricing of policies. In turn, this can help prevent underinsurance or over-insurance, benefiting both the customer and the insurance company.

4. Cost Savings for Customers

Customers who bundle their policies with the same insurance company can often receive a discount on their overall premiums. Some insurance companies claim you could save up to 25% on premiums if you bundle your insurance policies. This can lead to significant customer savings over time, increasing customer loyalty and retention rates.

5. Efficiency and Convenience

Selling multiple insurance policies to a customer can also have its benefits. It can simplify their life by eliminating the need to engage with multiple insurance agents or companies. They can handle all their insurance requirements with just one agent or company.

Consolidating policies with one company can improve efficiency and convenience for customers. They will only need to manage one policy and billing statement, and filing a claim for multiple policies can be easier with the same company.

How to Personalize Cross-Selling Insurance

At this point, you may be sold on the benefits of cross-selling insurance, but don't forget that personalization is key. Customers in different life stages and needs will require a tailored approach to reach them. Here are five tips to help you make the most out of your cross-selling efforts:

1. Educate Your Customers

Before suggesting an insurance product to customers, it is important to educate them on why they need it and how it can benefit them. For example, if you are selling life insurance, explain the various types of coverage available and when each type is appropriate.

2. Get to Know Your Customers

You can also personalize your cross-selling efforts by understanding the customer's needs. If a customer is a home buyer, consider suggesting additional coverage such as flood insurance or renter's insurance. You can better tailor their recommendations by understanding their unique needs and goals.

3. Utilize Technology

Technology can also help you personalize your cross-selling efforts. For example, by using customer segmentation, you can target customers likely to be interested in additional insurance products. You can also use predictive analytics to understand customer behavior better and determine what additional coverage they might need.

Implementing a CRM system is the most effective way to leverage technology to understand your customers' needs better and make personalized recommendations. It helps capture customer data and continuously track their progress. This way, you better understand the customer's needs and can better tailor your cross-selling efforts.

4. Track Your Success

This is also another instance where using a CRM system is beneficial. With it, you can track the success of your cross-selling efforts and measure the effectiveness of different strategies. This allows you to fine-tune your process and adjust accordingly over time.

5. Follow Up and Check In

Finally, don't forget to follow up with customers who have purchased additional insurance policies. Checking in with them periodically can help ensure they get the most out of their coverage and build customer loyalty. Keeping in touch is a great way to stay top-of-mind for your customers and may even lead to additional sales in the future.

Cross-selling insurance is a great way to increase customer loyalty and revenue for your business. Providing tailored recommendations based on customer needs can help you get the most out of your cross-selling efforts. With the right approach, you can build stronger relationships with customers, save them time, and increase their satisfaction with your services.

Top Tips for Cross Selling in the Insurance Industry

To ensure that you are successful in your cross-selling efforts, here are some tips for making the most out of your insurance sales:

1. Timing is Everything

Timing plays a crucial role in cross-selling insurance products. Choosing the right moment to introduce a new product or service to the client is essential. It would be best if you aimed to identify the right opportunities when the client is most receptive to the idea of purchasing additional coverage.

For example, suppose a client has recently bought a new car, and their current policy is about to expire. In that case, it would be an excellent opportunity to offer them additional coverage for their vehicle or a home insurance policy if they have recently purchased a new home.

Timing is also critical when it comes to following up with a client. If you wait too long to follow up, you might miss the chance to cross-sell an additional policy, and the client may decide to go elsewhere. However, if you follow up too soon, it may come across as too pushy and turn off the client. Therefore, it's essential to strike the right balance and find the perfect timing for follow-up calls or emails.

2. Showcase Your Offers

One of the most effective ways to cross-sell insurance products is by showcasing your offers to the client. You should be able to understand your client's needs and offer them personalized recommendations based on their requirements.

It's also crucial to provide clear information about your products and services, including their benefits and features. You could use brochures, website content, or videos to showcase your offers to clients. This will help clients understand the value of the additional coverage you're proposing and make informed decisions.

3. Survey Your Clients

One of the best ways to identify cross-selling opportunities is by surveying your clients. A survey can help you understand your client's needs and preferences, allowing you to offer personalized recommendations. You could use email surveys or phone interviews to collect client feedback.

Surveys can also help you identify potential areas for improvement in your products and services. For example, if several clients want more policy flexibility, you could introduce new coverage options or adjust your existing policies to meet their needs.

4. Keep it Friendly

Clients are more likely to respond positively if they feel that you genuinely care about their needs and aren't just trying to make a sale. It's very important to listen to your clients and address any questions or concerns they may have about the additional coverage you're proposing.

You should also avoid being too pushy or aggressive when cross-selling. Instead, focus on building a relationship with the client and providing valuable information to help them make an informed decision.

5. Illustrate How Your Clients Will Benefit

When cross-selling insurance products, it would be best to highlight the value and advantages of your proposed coverage, including any cost savings or added protection.

For example, if you're cross-selling a comprehensive health insurance plan, you could illustrate how it covers various medical expenses, including hospitalization, surgery, and prescription medication. Also, highlight how the policy could save the client money in the long run by reducing out-of-pocket expenses.

6. Use a Reliable CRM

A reliable customer relationship management (CRM) system can help you manage cross-selling opportunities effectively. A CRM can help you track client information, including their purchase history and preferences, allowing you to identify potential cross-selling opportunities.

Some of the features of a CRM that can help you better cross-sell products include:

- Automated reminders for follow-up calls or emails: A CRM can help you set up automated reminders to reach clients and offer additional coverage.

- Personalized recommendations: Using the data in your CRM, you can generate personalized product recommendations for each client.

- Analytics and reporting: You can use analytics and reporting tools to track your cross-selling efforts and identify areas for improvement.

By taking advantage of the features offered by a CRM, you can streamline your cross-selling process and make it easier to identify opportunities and maximize sales.

Conclusion

Cross-selling insurance products is an excellent way to increase revenue and build strong client relationships. However, it's crucial to approach cross-selling with a thoughtful and personalized strategy to ensure success. Following the tips above, you can find opportunities to cross-sell and use a reliable CRM to manage the process.

Consider using Ringy CRM as a dependable tool for managing your opportunities for cross-selling. With our platform's advanced features and easy-to-use interface, you can track client information, automate follow-up emails and calls, and generate personalized recommendations for your clients.

See the software in action to determine how Ringy CRM can help you increase your cross-selling success!

Skyrocket your sales with the CRM that does it all.

Calling? Check. SMS? Check. Automation and AI? Check. Effortlessly keep in touch with your customers and boost your revenue without limits.

Take your sales to new heights with Ringy.

Sales in a slump? Ringy gives you the tools and flexibility you need to capture leads, engage with them, and turn them into customers.

Subscribe to Our Blog

Enter your email to get the latest updates sent straight to your inbox!

Categories

Related Articles