Finding Commercial Insurance Leads [Strategies & Software]

Updated on

Updated on

By Robins Dorvil

By Robins Dorvil

Robins Dorvil

With over 7 years of experience in the insurance industry, 4+ years as an Account Executive at Ringy CRM, and 17 years as a Creative Real Estate Inves...

learn more

Robins Dorvil

With over 7 years of experience in the insurance industry, 4+ years as an Account Executive at Ringy CRM, and 17 years as a Creative Real Estate Inves...

Table of Contents

Table of Contents

We get it.

Searching for commercial insurance leads can make you feel like you are an intrepid explorer on a quest for hidden treasure. Instead of a dusty map, you're armed with data, strategies, and a determination that rivals Indiana Jones.

In this guide, we'll take you on an adventure, navigating the labyrinthine landscape of the insurance industry to unearth the secrets of building a formidable sales pipeline of commercial insurance leads.

This journey isn't about hunting for lost cities; it's about finding valuable connections and opportunities to help your insurance agency thrive.

With the proper knowledge and tools, you'll become a master of this domain, charting a course that leads to a boost in potential clients.

Strategies for Building a Pipeline of Commercial Insurance Leads

Building a robust pipeline of commercial auto insurance leads is essential for the success of any insurance professional or business. In today's competitive market, employing diverse strategies to identify, engage, and convert potential clients is crucial.

This section explores five key strategies to assist you in building a steady stream of commercial insurance leads.

Ask for Referrals

One of the most influential and often underutilized strategies for generating commercial insurance leads for agents is asking for referrals. Happy and satisfied clients can be your best source of new business.

When someone refers a friend, family member, or colleague to you, they are vouching for your services.

Here's how to make the most of this strategy:

- Cultivate Strong Client Relationships: Building strong, trust-based relationships with your existing clients is the first step. Clients are more likely to refer others to you if they are happy with your services.

- Timing Matters: Don't wait for referrals to happen naturally. Actively seek referrals when your clients are most satisfied, such as after a successful claim or policy renewal.

- Create Referral Incentives: Consider offering incentives to clients who refer others to you. These incentives include discounts on premiums, gift cards, or other rewards.

- Make It Easy: Simplify the referral process for your clients. Provide them with referral cards or an online form where they can easily submit referrals.

- Showcase Referral Success Stories: Share success stories of clients who benefited from referrals. This not only encourages more referrals but also demonstrates your expertise.

Referrals help you grow your client base and enhance your reputation and credibility in the industry. Remember, satisfied clients are often your best advocates, and asking for referrals is a win-win strategy for you and your clients.

Use Automated Lead Generation Technology

In the digital age, automation technology can significantly boost your lead generation efforts. Automating specific tasks and processes can save time and resources while reaching a broader audience.

Follow these steps to leverage automation effectively:

- Implement Customer Relationship Management (CRM) Systems: A CRM system helps you track leads, manage client interactions, and automate follow-ups. It ensures you never miss an opportunity.

- Email Marketing Automation: Email marketing is a potent tool for lead nurturing. Automate email campaigns to engage with leads at various buying cycle stages.

- Chatbots and Virtual Assistants: AI-powered chatbots can engage with website visitors 24/7, answer common questions, and collect lead information.

- Data Analytics: Use data analytics to identify patterns and trends in your lead generation efforts. This information can help you refine your strategies for better results.

- Case Studies on Effective Automation: Learn from real-world examples of insurance professionals who have successfully integrated automation into their lead generation processes.

Automation saves you time and ensures that no lead slips through the cracks, ultimately contributing to the growth of your commercial auto insurance leads pipeline.

Employ Inbound Marketing Strategies

Inbound marketing strategies that provide value to your target audience lead to organic and high-quality lead generation. Content marketing, SEO optimization, persuasive landing pages, and compelling CTAs are all key components of this approach.

Aligning your efforts with what your audience is searching for can naturally attract leads who are genuinely interested in your services.

Inbound marketing positions you as an industry expert and builds trust with potential clients, making it a sustainable strategy for growing small business insurance leads.

Use Social Media

Social media platforms offer an excellent opportunity to connect with potential clients, showcase your expertise, and generate leads.

Here's how to make the most of social media for lead generation:

- Platform Selection: Choose the platforms that align with your target audience. For B2B insurance, LinkedIn may be particularly valuable.

- Engaging Content: Create and share informative and engaging content on your social media profiles. This could include industry insights, client testimonials, and educational videos.

- Paid Advertising: To reach a wider audience, consider investing in paid advertising on social media platforms. Targeted ads can deliver impressive results.

Social media expands your reach and lets you personally connect with your audience. With the right strategy, it can become a valuable source of new leads for your insurance business.

Join Groups to Connect with Commercial Insurance Leads

Networking within industry-specific groups can be fruitful for generating commercial insurance leads.

Active participation, knowledge sharing, and showcasing your authority within these groups can help you connect with potential clients and build a professional reputation. By consistently providing value to group members, you position yourself as a trusted expert in commercial insurance.

Joining relevant groups is a long-term strategy that can yield enduring relationships and steady leads.

Considerations When Buying Commercial Insurance Leads

Purchasing commercial insurance leads is a strategic move to augment your lead generation efforts. However, it's imperative to approach this decision thoughtfully.

Let's explore essential considerations when buying commercial insurance leads to ensure that your investment yields the best results.

Identify Lead Agencies with Exclusive Leads

Exclusive leads are a valuable asset in lead generation. These leads are shared with only one buyer, significantly reducing competition and increasing the likelihood of conversion.

While they may come at a higher cost than shared leads, their exclusivity often translates into a higher quality and a better return on investment.

When considering lead providers, prioritize those offering exclusive leads. By doing so, you not only enhance your chances of closing deals but also reduce the risk of prospects being overwhelmed with multiple sales calls and emails, which can dilute your message.

Be Aware of Recycled Leads

Recycled or aged leads can be a potential pitfall when purchasing commercial auto insurance leads. These leads have often been sold to multiple buyers and may have received numerous sales calls.

As a result, their responsiveness and conversion potential tend to be lower than fresh leads.

Fresh leads are more likely to be receptive to your offerings and less tired by previous outreach attempts, improving your chances of successful conversion.

Look for Quality Over Quantity

In lead acquisition, quality should always precede quantity. Having fewer high-quality leads genuinely interested in your commercial insurance products and services is more advantageous than a large volume of low-quality leads unlikely to convert.

High-quality leads save you time and effort, resulting in higher conversion rates, ultimately contributing to a more efficient and successful lead-generation strategy.

Review Return Policies and Guarantees

When investing in commercial insurance leads, understanding the lead provider's return policies and guarantees is crucial.

Unforeseen circumstances can sometimes lead to prospects that do not meet your specified criteria or result in unsuccessful conversions. In such situations, having transparent refund or replacement options can protect your investment and help maintain your return on investment.

Before committing to a lead provider, inquire about their policies regarding leads that do not meet your expectations and ensure they align with your needs and expectations.

Seek References and Reviews

Before deciding on a lead provider, gather information from other insurance professionals using their services.

To determine the lead provider's reliability, lead quality, and customer service, look for the following:

- References

- Online reviews

- Testimonials

Hearing about the experiences of others in your industry can help you make an informed decision and ensure that the lead provider aligns with your business objectives.

Additionally, consider directly seeking references from the lead provider, as satisfied clients can further validate their services.

4 Marketing Collateral Ideas to Get Commercial Insurance Leads

Creating compelling marketing collateral is an indispensable lead generation strategy for commercial insurance. These materials serve as valuable tools for capturing the attention of potential clients, demonstrating your expertise, and ultimately converting leads into customers.

This section delves into four practical marketing collateral ideas to help you attract and engage small business insurance leads.

Optimize Your Website

A professional website design instills trust and credibility. A well-structured layout and intuitive navigation enhance user experience, making it more likely for visitors to engage with your services.

Furthermore, informative and user-friendly content is critical. Address your target audience's needs and concerns by clearly explaining your insurance offerings and how they benefit commercial clients. Customer testimonials can be showcased to add authenticity and significantly influence potential clients.

Let's look at this table exploring various types of lead magnets you can add to your website.

|

Lead Magnet Type |

Description |

|

In-depth reports on industry trends, risk management, or policy types. |

|

|

eBooks |

Comprehensive guides covering commercial insurance topics. |

|

Webinars |

Live or recorded webinars on insurance-related subjects. |

|

Case Studies |

Success stories showcasing how your services benefited clients. |

|

Risk Assessment Tools |

Interactive tools that help businesses assess their insurance needs. |

Utilizing these lead magnets encourages lead engagement and information collection on your website. Strategically placed contact forms throughout your website make it easy for visitors to inquire about your services or request quotes.

Similarly, clear and persuasive call-to-action (CTA) buttons guide visitors toward specific actions, such as "Request a Quote" or "Get in Touch."

Utilize Social Media

Begin by identifying your target audience's most frequented social media platforms.

Regularly share informative and engaging content, including industry insights, insurance tips, and updates. Mixing in visually appealing elements like infographics and videos can make your content more shareable and engaging.

Paid advertising on social media platforms is another effective strategy. Targeted ads can reach a wider audience and generate valuable leads. Actively engaging with your audience by responding to comments, answering questions, and participating in relevant discussions builds rapport and trust. Hosting webinars or live Q&A sessions can showcase your expertise and provide valuable information. Promote these events through your social media channels.

Utilizing lead generation forms on platforms that offer this feature allows interested parties to express their interest in your services directly.

Write Blog Posts

Blogging is a versatile and effective method for providing valuable information, demonstrating expertise, and attracting potential clients.

Start with thorough keyword research to identify topics and phrases relevant to commercial insurance that potential clients are searching for.

Create comprehensive and informative blog posts addressing common questions and concerns about commercial insurance. Offering actionable insights and advice is essential.

Maintain a regular posting schedule to keep your audience engaged and informed. Consistency builds trust and encourages return visits. Enhance your blog posts with visual elements such as images, infographics, and charts to make the content more engaging and shareable.

Collaborating with industry experts or influencers to write guest posts on your blog can expand your reach and credibility.

Create Email and SMS Campaigns

Email and SMS campaigns are powerful tools for generating commercial insurance leads.

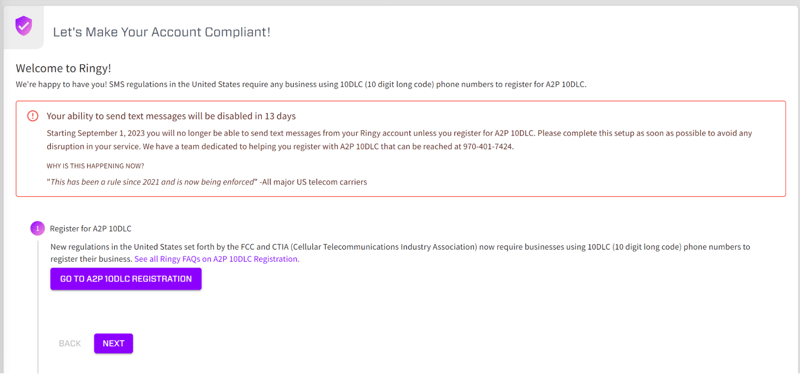

However, being aware of SMS compliance regulations in the United States is vital, specifically A2P 10DLC. A2P 10DLC enables businesses to send text messages using regular 10-digit phone numbers. Compliance is crucial, as non-registered numbers can be blocked.

Ringy's users can register for A2P in their account by going to the Phone Setup page and following the instructions under the Business Profile tab.

Begin by crafting visually appealing and responsive email templates that align with your brand's identity. These templates should entice recipients to read further. Subsequently, develop informative content within these emails, addressing the unique needs of your commercial insurance prospects with persuasive language.

Turning our attention to SMS campaigns, due to character limitations, concise and impactful messages are essential. These messages should convey your value proposition directly. Similar to email, SMS messages should incorporate clear and actionable CTAs.

Encourage recipients to take specific actions, such as visiting a website or requesting a quote. Don't forget to ensure that linked pages are optimized for mobile devices to deliver a seamless user experience.

Commercial Insurance Leads - Final Thoughts

Pursuing commercial insurance leads can often feel like a complex puzzle. As you piece together strategies like referrals, automated lead generation, and compelling email campaigns, you're on a journey that requires perspicacity and wisdom.

But what if there was a way to simplify this puzzle?

Enter Ringy, your all-in-one solution CRM sales software for managing commercial insurance leads. With Ringy, you can streamline your lead generation efforts, make VoIP calls, organize contacts, create DRIP campaigns, and focus on what matters most—building valuable connections and growing your business.

Don't let the complexities of lead generation weigh you down. Take the next step with Ringy and discover how effortless managing commercial insurance leads can be.

Request a demo to explore how Ringy can be your trusted partner in the insurance lead adventure.

Skyrocket your sales with the CRM that does it all.

Calling? Check. SMS? Check. Automation and AI? Check. Effortlessly keep in touch with your customers and boost your revenue without limits.

Take your sales to new heights with Ringy.

Sales in a slump? Ringy gives you the tools and flexibility you need to capture leads, engage with them, and turn them into customers.

Subscribe to Our Blog

Enter your email to get the latest updates sent straight to your inbox!

Categories

Related Articles