5 Strategies to Maintain a Good Return on Sales

Updated on

Updated on

By Carlos Correa

By Carlos Correa

Carlos Correa

Carlos has been involved in the sales space for well over ten years. He began in the insurance space as an individual sales agent, managing teams as s...

learn more

Carlos Correa

Carlos has been involved in the sales space for well over ten years. He began in the insurance space as an individual sales agent, managing teams as s...

Table of Contents

Table of Contents

Maintaining a good return on sales is fundamental to sales organizations globally.

In a world where profit margins can be as elusive as a black cat on Friday the 13th, mastering the art of maintaining a stellar return on sales is akin to wielding the Excalibur in business.

This article explores the return on sales definition, explains how to calculate it, shares a few examples, and showcases our top five strategies for maintaining a good return on net sales.

Because let's face it, in the game of business, you either stay ahead or become yesterday's leftovers in the corporate fridge.

Return on Sales Definition

Return on sales, also known as Operating Margin or Operating Profit Margin, is a very important financial indicator used by companies to evaluate their economic situation. It measures the result of the organization's effort to match its profits with sales in the form of a rate.

ROS has always been essential in various industries and sectors since it represents a benchmark for competitiveness analysis and reporting. Its simplicity and universality help it to become understandable to multiple groups of people, such as:

- Executives

- Investors

- Analysts

- Stakeholders

Through measures of ROS over time, you can monitor the progress of the goals of your sales channel strategy, pinpoint weaknesses, set things right, and raise productivity in other operations.

Budgeting by return on sales analysis aids in deciding on a fixed figure of financial targets and moves the decision-making process toward your unique strategic objective. It also enables management to identify cost reduction options and manage the production process in the most affluent manner.

What Is a Good Return on Sales

Achieving a favorable return on sales between 5 and 20 percent signifies robust operating profitability relative to net revenues, with the specific threshold contingent upon industry benchmarks. It indicates the efficiency of your company's operations in converting sales into profits after considering costs. Notably, industries exhibit varying cost structures, influencing what constitutes an acceptable ROS.

To assess your business's return on sales, it's crucial to benchmark against competitors within the same industry.

Continuously track return on sales trends over time to:

- Discern patterns

- Evaluate the impact of strategic initiatives on profitability enhancement

By doing so, you can ascertain whether improvements in ROS stem from your business enhancements or adaptive selling efforts.

For meaningful ROS comparisons, consider utilizing resources such as SEC EDGAR company filings for competitor analysis or purchasing industry-specific statistics.

These tools offer insights into industry norms and allow informed decision-making regarding performance evaluation and tweaking your sales and marketing strategy.

How to Calculate Return on Sales

A significant financial indicator is a return on sales; it's based on the idea that a company's profitability could be determined by evaluating its ability to profit from sales revenue.

Calculating return on sales involves a straightforward formula, which consists of obtaining two key figures from the company's income statement: net sales and operating income or EBIT.

Here's a step-by-step guide on how to calculate ROS and its different variations:

Return on Sales Formula

Return on Sales (ROS) = (Operating Profit / Net Revenue)

Where:

Operating Profit represents the profit derived after subtracting all expenses from revenue.

Net Revenue indicates the total revenue generated by the company.

Return on Sales Ratio

ROS is typically expressed as a ratio, usually represented as a percentage. A higher ROS signifies superior profitability, indicating that the company is earning more profit per unit of sales.

Return on Sales Percentage

To round off the return on sales to a percentage, we need to multiply the formula outcome by 100.

For instance, a return on sales of 16.67% suggests that the company earns 16.67 cents in profit for every dollar of sales. This implies efficient conversion of sales into profit.

However, interpretation may vary across industries and other contextual factors. Comparing ROS with industry benchmarks and historical performance can offer deeper insights into a company's profitability and operational efficiency.

It's worth noting that the ROS formula does not account for non-operating expenses such as financing structure and taxes. By excluding factors like interest expense and income tax expense, the ROS calculation provides a clearer understanding of the core operational profitability of a business.

How to Find Return on Sales

Understanding your company's profitability is critical to effective financial management and decision-making. However, knowing where and how to find the elusive return on sales metric is vital to this evaluation.

Return on sales measures the percentage of revenue that converts into profit after accounting for all operating expenses.

Several steps need to be followed to compute return on sales.

Check them out below:

- Determine operating profit: First, subtract all operating costs from the total revenue to get the operating profit. The typical direct above-the-line costs include the cost of goods sold (COGS), wages, rent, utilities, and depreciation expenses incurred directly due to the production process. Operational Profit = Total Income - Operating Cost.

- Calculate ROS ratio: Once you get the operating profit, divide it by the net revenue (total sales), giving a return on sales ratio. The margin reflects how much revenue a company pulls in after deducting all its expenses. ROS Ratio = (Operating Profit/Net Revenue) × 100

- Convert ratio to percentage: ROS is usually shared as a percentage. Thus, multiply the obtained ROS ratio by 100 to create the ratio in % values. ROS percentage = ROS Ratio x 100

By following these steps to calculate ROS, you can better understand your financial performance and make informed decisions to improve profitability.

Return on Sales Example

Consider a remote-selling business that generates $900,000 in sales revenue during the fiscal year. Over the same period, the firm incurs $600,000 in operating expenses, resulting in an operating profit of $300,000.

Operating Profit = $300,000

Net Revenue = $900,000

ROS Ratio = (Operating Profit / Net Revenue) = ($300,000 / $900,000) = 0.3333

ROS Percentage = ROS Ratio × 100 = 0.3333 × 100 = 33.33%

This means that the firm's return on sales is 33.33%. In simpler terms, the firm earns approximately 33 cents in profit for every dollar of sales.

Return on Sales Example 2

Consider a retail store chain that achieves $2,500,000 in sales revenue annually. After accounting for all operating expenses, including inventory costs, employee salaries, rent, and utilities, the store chain's operating profit amounts to $600,000.

Operating Profit = $600,000

Net Revenue = $2,500,000

ROS Ratio = (Operating Profit / Net Revenue) = ($600,000 / $2,500,000) = 0.24

ROS Percentage = ROS Ratio × 100 = 0.24 × 100 = 24%

In this scenario, the retail store chain's return on sales is 24%. This indicates that the company earns 24 cents in profit for every dollar of sales.

These examples illustrate how return on sales (ROS) can be calculated to evaluate a company's profitability based on different sales cycles, figures, and operating expenses (Take the average SaaS sales cycle as an example.)

Monitoring ROS over time helps businesses assess their financial performance while offering insight to instigate data-driven decision-making.

5 Strategies to Maintain a Good Return on Net Sales

A good return on sales keeps your business in the clear and financially healthy from the start to the end. ROS assesses the ability of a company to generate profit from the revenue after subtracting all ordinary costs.

This section discusses the top five strategies businesses can apply to keep their return on sales sturdy.

Cost Control Measures

Cost control measures are aimed at taking on the methodic and strategic approach to managing expenditures to ensure the maximum efficiency of resource utilization and maximize profitability levels.

You can improve your return on sales by controlling costs, which will work in your favor.

Here are a few key strategies for cost control:

- Budgeting and expense tracking: Develop a holistic budgeting method that will work for allocating resources to set precise SMART sales goals. Accurate expenditure tracking will help spot any discrepancies in the budget; this should be done promptly and with corrective actions. Use accounting or sales software to ease the preparation of budgets and expenditure tracking.

- Negotiating supplier contracts: Seek the best from suppliers in using discounts, rebates, and better terms on supplier payments. Consolidate buying for procurement, seeking optimal cost and efficiency. Constantly audit and balance the supplier contracts to identify the cost savings potential and, if necessary, renegotiate them.

- Streamlining operations: Rationalize procedures based on efficiency to eliminate wastage and cut logistics costs. Identify and diminish the existence of extra-money-wasting activities that occur and add up to unnecessary expenses. Utilize outbound technology and CRM automation tools to enhance productivity and lower labor costs. This consists of continuous performance appraisals to improve resource usage, as well as other activities.

- Inventory management: Inventory management is essential for efficient operations. Your company must use inventory management practices to reduce carrying costs and avoid shortages and extra stock records. Apply inventory forecasting methods and find the right balance of demand and supply to optimize inventory levels precisely. Implementing a cycle-of-supply inventory system to reduce storage expenses can enhance liquidity, especially with the proper method.

- Cost-conscious culture: An organization should cultivate a cost-conscious environment by publicizing cost-reduction opportunities and inviting employees to participate in expense-reduction tasks. It should also give employees competent training and positive reinforcement to observe cost-consciousness and develop a cost-savings mindset.

The key cost control processes must be established while the return on sales is maintained for future financial improvement. Companies of all sizes can create profitability that lasts by following a budget, tracking expenses of all sorts, negotiating contracts with their suppliers, putting efforts into streamlining their operations, optimizing their inventory management, and instilling a focus on making the best use of all operational resources.

Revenue Optimization Strategies

Revenue performance strategies are very important in increasing speculative revenue and augmenting financial performance goals. Organizations that implement smart revenue optimization strategies are bound to experience an improved return on net sales, thereby realizing continuous growth and success.

Here, we break down five revenue optimization strategies in this simple table.

|

Strategy |

Description |

|

Market Segmentation and Targeting |

Identify target markets and tailor marketing strategies and messaging effectively. |

|

Pricing Optimization |

Implement dynamic pricing strategies based on market demand and customer willingness to pay. |

|

Product and Service Innovation |

Continuously innovate and diversify offerings to meet evolving customer needs and preferences. |

|

Sales Force Effectiveness |

Invest in training and development programs to enhance sales team productivity and effectiveness. |

|

Develop strong relationships with customers through personalized communication and engagement. |

Productivity and efficiency are more than just buzzwords in the company sector; they allow the company to set a high return on net sales, leading to business prosperity.

An organization's primary goal is to optimize processes, allocate resources, train and develop employees, set up practical performance assessment and status metrics, and apply optimized management principles to achieve greater operational performance, profitability enhancement, and sustainable growth.

Focus on Productivity and Efficiency

Maximized work ethic and productive efficiency are the two primary goals for businesses that want a good return on sales ratio and to be in profit for the long term. By reducing time wastage, using resources efficiently, and streamlining processes, you stand a better chance of improving profitability.

Let's explore five ways to increase your focus on productivity and efficiency.

- Process optimization: Define your workflow while rebuilding and improving business processes affecting productivity and increasing costs. Adopt automation software to eliminate manual work and simplify repetitive processes. Use regular and thorough process evaluations to determine the areas that need optimization or improvement.

- Resource allocation: Allocate your resources to maximize their performance and benefits while reducing manual tasks to a minimum. Perform regular checks to determine the best placements for your resources and direct them to where they are needed most. Use resource management tools and software that manage allocation to get 100% value from your available resources.

- Employee training and development: Support staff growth by organizing training programs to improve their professional abilities. Supply your workers with all the necessities, including the tools, training, and encouragement needed for them to succeed. Enable a learning and growth culture to encourage staff members to upgrade their abilities and bring their best to your company.

- Performance metrics and KPIs: Set quantitative parameters and performance measures, including key performance indicators (KPI) that aid in measuring employees' productivity and, thus, the organization's efficiency. Provide analysis of performance metrics at regular intervals and, based on data-driven insights, justify cases of performance improvement areas and optimization initiatives. When completing their task successfully, considering the agreed KPI goals, provide the employee feedback and recognition.

- Lean management principles: What is crucial is lean management methodology and practices that help eliminate mundane work activities, reduce lead times, and improve efficiency. Introduce strategies like Lean Six Sigma for grouping and eliminating time-wasting tasks while trying to have them run more efficiently. Make sure that the lean initiatives are not someone else's but a bespoke version tailored to your vision for a better organization; this should help to create a culture of ongoing improvement.

Concentrating on efficiency and productivity can boost your results if you want to maintain an optimal return on sales. While the above steps can help you achieve your goal of higher profitability, it's essential to remain consistent when implementing each initiative into your organization.

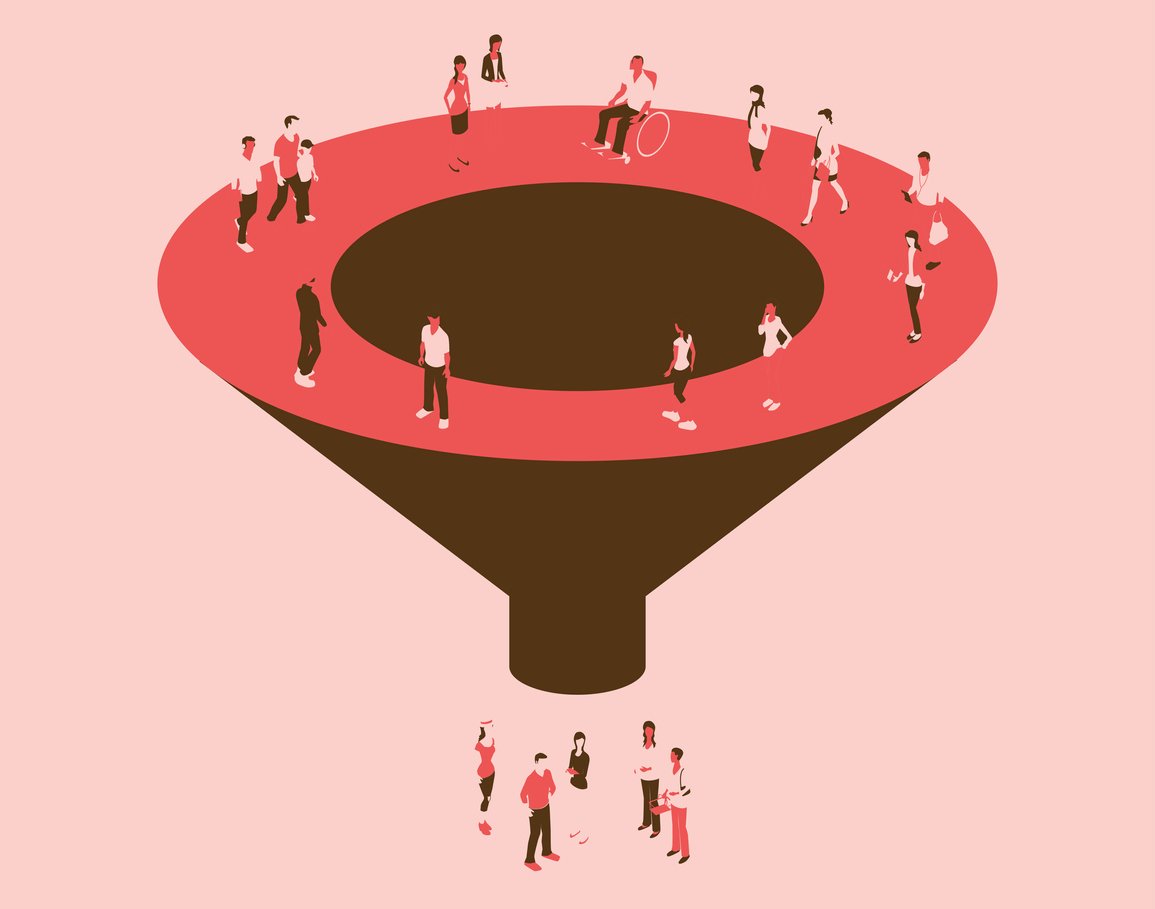

Customer Relationship Management

This is one of the most important aspects of improving your return on sales. Customers are the lifeblood of your business; without them, you would fail to achieve your sales and operational objectives.

Customer relationship management should be at the forefront of your sales initiatives. It should ensure that clients are taken care of no matter when they enter your sales funnel. CRM is a strategic approach to fostering deeper connections with customers and prospects to drive sales growth while improving customer satisfaction and maximizing returns.

Since CRM is our business, we would love to share our favorite key strategies for boosting customer satisfaction, retention, and loyalty.

- Personalized communication: Design customized communication tactics that let you interact with customers in a way that makes them feel unique and addresses their requirements. Use customer data and insights to provide personalization through specific email messaging, offers, and promotions. Email marketing, social media, and other digital tools are used to develop and release targeted, valuable customer messages.

- Exceptional customer service: Provide outstanding customer service at every interaction to surprise and delight customers, drive loyalty, and build solid relationships. Train customer service staff to engage clients by remembering names, being responsive, anticipating problems, and replying appropriately to increase satisfaction. Implement customer service technologies, like live chat and chatbots, to supply real-time aid and support to customers.

- Proactive engagement: Consciously connect with customers at each step of their journey with your company to establish loyal patrons. Encourage customers to provide feedback via an email request after a purchase. Answer any questions and show appreciation to the customers for the business they've given you. Introduce customer loyalty programs and rewards to increase visitor conversions to regular customers by encouraging repeat buying.

- CRM software and tools: Purchase CRM software (Like Ringy) and systems that compile all client information in one place, facilitate constant communication, and automate marketing and sales procedures. CRM systems should be adopted to monitor customer interactions, desires, and buying patterns, allowing more individualized and customized marketing and selling activities. Enhancing CRM analytics, including auditing and reporting tools, can also help you improve return on sales. Use these tools to gain valuable information regarding customer behavior and optimize marketing and sales strategies accordingly.

- Customer feedback and insights: Harness and assess customer feedback and input to understand their needs, preferences, and problems. Run frequent surveys, interviews, and focus groups that will engage customers in voicing their positive and negative opinions and lead to identifying problem areas—use customer feedback to instigate data-driven decision-making and improve your products, services, and processes.

Effective CRM cannot be overstated. It helps form the backbone for a good return on sales by nurturing customer relationships, enhancing satisfaction, boosting loyalty, and ultimately driving repeat business.

With this proactive approach to engagement and personalization, you can strengthen connections while improving retention and driving your profitability through the roof!

Financial Planning and Forecasting

Last but certainly not least is financial planning and forecasting.

Financial planning and forecasting are the main factors in effective strategic decision-making for small start-ups and multinational enterprises. These methods not only predict future economic outcomes using past data, recent market trends, and similar circumstances but also stipulate risks.

Through proper budgeting and forecasting, which is essential in sound financial planning, you know clearly what you want, how to allocate the resources, and the right decisions to allow you to attract and sustain a high degree of profitability.

Check out the table below outlining key financial planning and forecasting strategies.

|

Strategy |

Description |

|

Budgeting and Forecasting |

Develop comprehensive budgets and financial forecasts to set clear financial goals. |

|

Cash Flow Management |

Implement effective cash flow management practices to optimize cash flow and liquidity. |

|

Capital Allocation |

Allocate capital strategically to fund growth initiatives and optimize shareholder returns. |

|

Risk Management |

Identify and assess financial risks and implement risk management strategies to mitigate risks. |

|

Performance Monitoring and Analysis |

Monitor key financial metrics and analyze performance to track progress toward financial goals. |

Financial planning and forecasting play an indispensable role in business success. They allow firms to make strategies and plans to cope with uncertainty and obtain profit. With precise financial goal setting, appropriate management of all available resources, and vetted decisions, you can increase your return on sales and uphold long-term financial stability.

Developing the necessary action plan ensures your company is well-equipped to deal with market condition shifts and bolster its success in a constantly changing environment.

Return on Sales - Final Thoughts

Implementing the five strategies outlined above is essential for businesses to maintain a good return on sales and ensure profitability in the long run. Focusing on cost control measures, revenue optimization strategies, productivity and efficiency, customer relationship management, and financial planning and forecasting can optimize sales performance and drive sustainable growth.

However, navigating these strategies requires the right tools and technology.

That's where Ringy comes in.

As a comprehensive CRM and sales software solution, Ringy streamlines the entire sales process, from prospecting to closing deals. With features designed to manage prospects, leads, and customers seamlessly, Ringy gives your business the tools to maximize sales efficiency and effectiveness.

With Ringy as your sales partner, you can leverage data-driven insights and automation to enhance your sales strategy, improve customer relationships, and ultimately achieve a stellar return on sales.

Request a demo and watch your sales figures soar to new heights!

Skyrocket your sales with the CRM that does it all.

Calling? Check. SMS? Check. Automation and AI? Check. Effortlessly keep in touch with your customers and boost your revenue without limits.

Take your sales to new heights with Ringy.

Sales in a slump? Ringy gives you the tools and flexibility you need to capture leads, engage with them, and turn them into customers.

Subscribe to Our Blog

Enter your email to get the latest updates sent straight to your inbox!

Categories

Related Articles