Customer Lifecycle Management: A Complete 2026Strategy Guide

Updated on

Updated on

By Carlos Correa

By Carlos Correa

Carlos Correa

Carlos has been involved in the sales space for well over ten years. He began in the insurance space as an individual sales agent, managing teams as s...

learn more

Carlos Correa

Carlos has been involved in the sales space for well over ten years. He began in the insurance space as an individual sales agent, managing teams as s...

Table of Contents

Table of Contents

Customer relationships rarely fail all at once. They erode in small, expensive moments. Slow follow-ups, missed handoffs, clunky onboarding, or a renewal that feels more like a surprise than a decision. Customer lifecycle management brings order to that chaos by treating every interaction as part of a connected system, not a one-off event.

Instead of chasing deals and hoping retention works itself out, teams that take customer lifecycle management seriously know exactly where prospects stall, why customers stay, and when revenue is at risk. The payoff is consistency across sales calls, SMS follow-ups, onboarding workflows, and long-term account growth.

And once automation, clean data, and real-time visibility enter the mix, things get interesting. The lifecycle stops feeling reactive and starts working like a well-run operation that quietly does its job while your team focuses on closing, serving, and scaling.

Key Takeaways

- Customer lifecycle management connects acquisition, conversion, retention, and loyalty into one revenue-driven system rather than isolated tactics.

- A strong customer lifecycle management strategy reduces CPA and churn by aligning data, automation, and timing across every customer touchpoint.

- AI-driven personalization and predictive analytics turn customer lifecycle management systems from reactive tools into proactive growth engines.

- Industry-specific execution matters, especially for customer lifecycle management in financial services, telecom, startups, and agencies.

- The most effective customer lifecycle management platforms unify calling, SMS, automation, and pipeline visibility to scale without losing personalization.

What Is Customer Lifecycle Management?

Customer lifecycle management is the structured process of managing every interaction a customer has with a business, from first contact to long-term loyalty.

The customer lifecycle management definition centers on aligning data, automation, and strategy across marketing, sales, and customer success to maximize lifetime value while reducing acquisition and retention costs.

The Difference Between CRM (the Tool) and CLM (the Strategy)

A Customer Relationship Management (CRM) is a system of record designed to capture and organize customer data. Customer lifecycle management is the strategic framework that governs how that data is activated across every stage of the relationship to drive revenue, efficiency, and long-term value.

Here's how they differ in detail:

|

Aspect |

CRM (Customer Relationship Management) |

CLM (Customer Lifecycle Management) |

|

Core Purpose |

Store and organize customer data |

Orchestrate the full customer journey |

|

Primary Focus |

Activities and records |

Revenue efficiency and lifecycle progression |

|

Scope |

Sales and contact management |

Marketing, sales, retention, and loyalty |

|

Automation Role |

Task-based and manual triggers |

Stage-based, behavior-driven automation |

|

Impact on CPA |

Limited without a strategy |

Actively lowers CPA through prioritization |

|

B2B Effectiveness |

Strong as a support tool |

Strong as a growth and retention strategy |

This distinction matters because customer lifecycle management systems focus on revenue efficiency, not just activity tracking. Businesses that adopt data-driven customer lifecycle management consistently lower CPA by prioritizing the right prospects, shortening sales cycles, and improving retention.

In B2B environments, this approach often outperforms standalone CRM SaaS customer lifecycle management setups that lack lifecycle logic and automation.

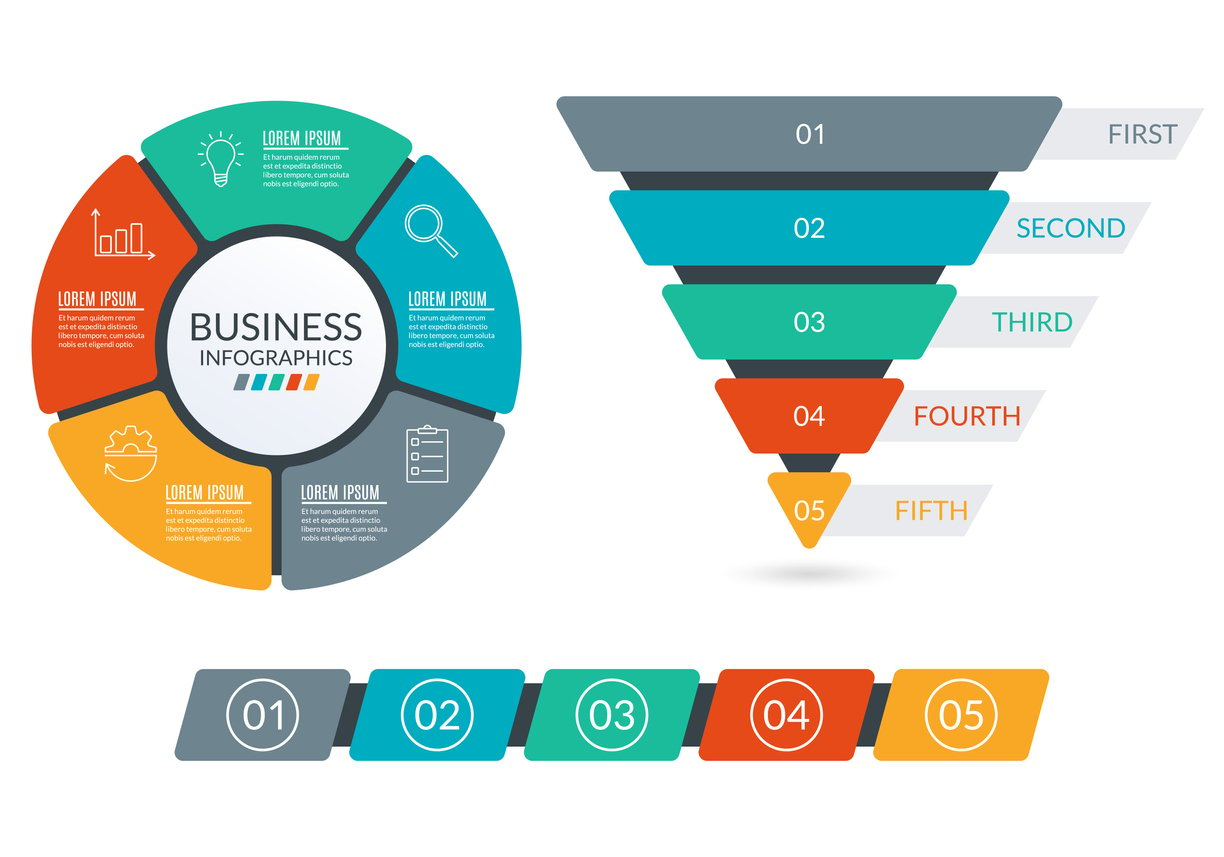

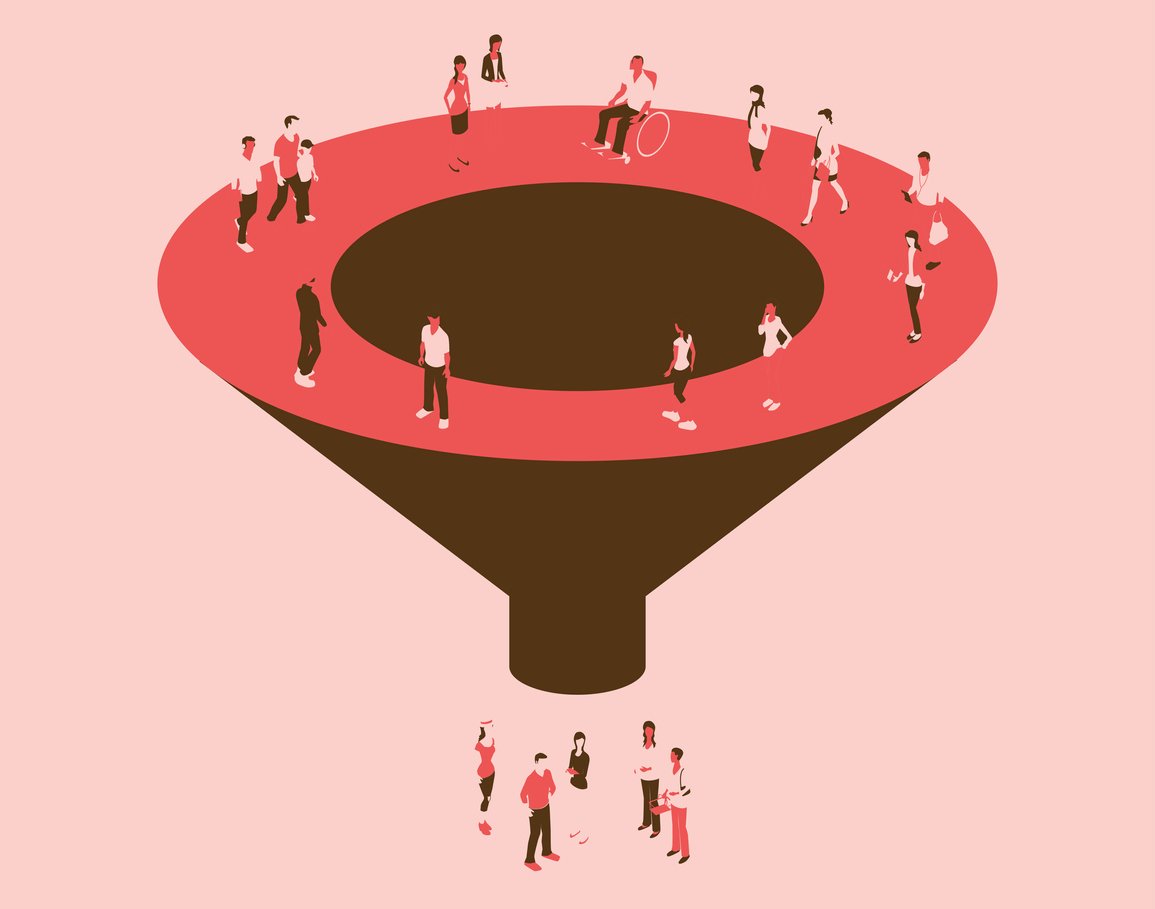

The 5 Essential Stages of the Customer Lifecycle

Customer lifecycle management stages create a repeatable framework that connects CLM marketing, sales, and post-sale engagement into one system. High-performing customer lifecycle management platforms optimize each stage with automation and real-time visibility.

Stage 1: Reach

The reach stage focuses on visibility and demand generation. SEO, content, and social media are primary customer lifecycle management tools here, helping businesses attract prospects already searching for solutions. In telecom and financial services, this stage is critical for controlling customer lifecycle risk management by targeting qualified traffic instead of volume.

Research shows that companies publishing regular blogs generate 55% more website visitors, making organic reach a compounding asset. The goal here is to be found, trusted, and remembered when interest turns into action.

Stage 2: Acquisition

Acquisition turns attention into action. Personalized SMS, email, and call outreach convert prospects into leads by meeting them where they are. Customer lifecycle management solutions that centralize communication, such as those Ringy offers, ensure no lead slips through the cracks while lowering response times and acquisition costs.

According to Salesforce research, 73% of customers expect companies to understand their unique needs. Effective acquisition narrows the gap between curiosity and commitment by delivering the right message at the right moment.

Stage 3: Conversion

Conversion is where intent becomes revenue. Automated workflows, CRM integrations, and customer lifecycle management software streamline follow-ups and remove friction from the buying process.

Tools like power dialers help sales teams connect faster and more consistently, reducing response time when interest is highest. Clear value propositions, timely outreach, and data-backed sales actions work together to close deals efficiently without sacrificing personalization or trust.

Stage 4: Retention

Retention keeps customers engaged long after the sale. Drip campaigns, onboarding sequences, and usage reminders are especially critical for customer lifecycle management in financial services, where trust and timing drive long-term value.

Consistent communication reassures clients, reinforces expertise, and prevents churn. By proactively addressing needs and offering relevant insights, brands shift from transactional interactions to ongoing relationships that grow in both loyalty and lifetime value.

Stage 5: Loyalty and Advocacy

Loyalty turns satisfaction into growth. A unified customer lifecycle management system tracks engagement, identifies promoters, and creates opportunities for referrals, reviews, and upsells.

When customers feel recognized and rewarded, they naturally advocate on your behalf. This stage closes the loop, where marketing becomes customer-driven, acquisition costs drop, and your strongest growth channel is the clients who already trust you.

Building a Winning Customer Lifecycle Management Strategy

A strong customer lifecycle management strategy connects data, timing, and execution across every stage of the journey. The goal is smarter engagement that compounds over time. Modern customer lifecycle management systems rely on automation, AI, and behavioral intelligence to move customers forward efficiently while protecting long-term value.

1. Use AI-Driven Personalization

AI has shifted customer lifecycle management from rules-based automation to adaptive, learning-driven systems. Instead of broad segments, customer lifecycle management software now tailors journeys at the individual level.

Key applications include:

- Hyper-Segmentation: Machine learning models analyze behavior, intent signals, and engagement patterns, enabling customer lifecycle management tools to go far beyond basic demographics.

- Scalability: Automated customer lifecycle management platforms can orchestrate thousands of personalized journey paths simultaneously, something manual workflows can't support.

- Recommendation Engines: “Next Best Action” logic dynamically suggests offers, content, or outreach based on lifecycle stage, improving conversion and retention rates. McKinsey reports AI-driven personalization can lift revenue by 10–15%.

This approach is becoming foundational in AI for customer lifecycle management across B2B and SaaS environments.

2. Create Omnichannel Journeys

Customers interact across multiple touchpoints, and customer lifecycle management solutions must treat those interactions as one continuous experience. Disconnected channels create friction and inflate acquisition costs.

Effective omnichannel customer lifecycle management systems focus on:

- Unified Customer Profiles: Centralized data ensures sales, marketing, and support share the same context, critical for customer lifecycle management in telecom and financial services.

- Channel Continuity: Abandoned actions on one channel should be reflected instantly across others, preserving intent.

- Contextual Messaging: Smart suppression logic prevents over-messaging, improving engagement while lowering unsubscribe and opt-out rates.

Platforms like Ringy support omnichannel execution by consolidating calls, SMS, email, and pipeline activity into a single customer lifecycle management system software layer.

3. Use Predictive Analytics to Anticipate Customer Needs

Data-driven customer lifecycle management is proactive by design. Predictive models surface opportunities and risks before they become visible to human teams.

Core predictive capabilities include:

- Churn Propensity Models: Identify declining engagement early and trigger automated recovery workflows, a priority in customer lifecycle management in banking and subscription-based services.

- Predictive Lead Scoring: Rank prospects by likelihood to convert, allowing sales teams to focus on high-impact lifecycle transitions.

- Lifetime Value Forecasting: Align spend and effort with customers expected to generate the greatest long-term returns.

4. Respond Quickly With Real-Time Behavioral Targeting

Timing often outweighs messaging. Customer lifecycle management technology that reacts in real time captures intent at its peak.

High-impact tactics include:

- Event-Based Triggers: Automatically respond to actions like pricing page visits, demo requests, or cart abandonment.

- Location-Based Context: Geofencing supports contextual offers, particularly relevant for customer lifecycle management, telecom and retail use cases.

- In-Session Optimization: Adjust offers, messaging, or UI elements while the user is still active, increasing conversion probability.

This real-time responsiveness is a defining feature of modern customer lifecycle management platforms.

5. Boost Engagement with Dynamic Content

Static experiences limit performance. Dynamic content allows customer lifecycle management systems to assemble messages at the moment of interaction, based on live data.

Execution strategies include:

- Modular Content Design: Swap content blocks dynamically using preferences, behavior, or external signals like inventory or location.

- A/B testing at Scale: Automated testing lets customer lifecycle management software optimize performance continuously across micro-segments.

- Urgency and Social Proof: Real-time signals such as scarcity or activity indicators increase action rates without manual intervention.

Dynamic content plays a central role in advanced customer lifecycle management best practices, especially for B2B customer lifecycle management solutions where buying cycles are longer and trust-driven.

Together, these five pillars transform customer lifecycle management from a static process into a living system that adapts, learns, and scales with the business.

Industry Spotlight: Lifecycle Management in Specialized Sectors

Customer lifecycle management looks different across industries, but the objective stays the same: reduce friction, increase lifetime value, and manage risk at scale.

The difference lies in data complexity, communication volume, and regulatory pressure, areas where the right customer lifecycle management system makes or breaks performance.

Customer Lifecycle Management in Financial Services

Customer lifecycle management in financial services depends on trust, timing, and compliance. Banks, lenders, and fintech companies manage long relationship histories that span onboarding, verification, servicing, renewals, and cross-sell.

Effective customer lifecycle management solutions in this sector focus on:

- Consistent Follow-Ups: Automated reminders and lifecycle-triggered outreach help maintain engagement without manual oversight.

- Risk-Aware Engagement: Customer lifecycle risk management models flag unusual behavior or declining engagement early.

- Relationship Continuity: Centralized profiles ensure advisors and support teams always have full context.

Customer Lifecycle Management in Telecom

Customer lifecycle management telecom environments operate at scale, often managing millions of customers across acquisition, usage, upgrades, and churn prevention. High communication volume makes automation non-negotiable.

Strong customer lifecycle management systems in telecom emphasize:

- Churn Reduction: Behavioral triggers identify usage drops and trigger automated SMS or call outreach before cancellation.

- High-Volume Communication: Automated SMS, VoIP, and call workflows keep costs predictable while maintaining reach.

- Real-Time Engagement: Usage-based alerts and upgrade prompts increase Average Revenue Per User (ARPU) without added sales pressure.

With Ringy, you get a unified workflow that combines SMS, calling, automation, and lead management into a single customer lifecycle management sales software.

CLM for Startups and Agencies

For startups and agencies, customer lifecycle management is about scale without losing personalization. Early-stage growth often breaks processes before teams realize it.

Customer lifecycle management best practices for this segment include:

- Structured Growth: Defined customer lifecycle management stages prevent leads and clients from falling through gaps.

- Personalized Automation: AI-driven workflows preserve a human feel while handling increasing volume.

- Revenue Predictability: Clear lifecycle visibility supports better forecasting and resource allocation.

FAQs About Customer Lifecycle Management

The questions below address common search queries around customer lifecycle management.

What is the difference between customer lifecycle management and contract lifecycle management?

Customer lifecycle management focuses on the entire relationship, from acquisition through retention and advocacy. Contract lifecycle management concentrates on agreements, creation, approvals, renewals, and compliance.

When integrated, customer lifecycle management and contract lifecycle management improve forecasting, reduce churn at renewal points, and align customer success with revenue outcomes.

How does customer lifecycle management reduce customer acquisition costs?

Customer lifecycle management lowers CPA by prioritizing high-intent prospects, improving lead scoring, and reducing wasted outreach. Data-driven customer lifecycle management systems optimize timing, messaging, and channel selection, increasing conversion rates while requiring fewer touches per deal.

What should businesses look for in a customer lifecycle management platform?

A strong customer lifecycle management platform should unify communication, automation, analytics, and pipeline visibility. Look for omnichannel support, real-time behavioral triggers, predictive insights, and scalability. The best customer lifecycle management software supports growth without increasing operational complexity.

Conclusion

What separates high-performing organizations is how well their customer lifecycle management systems execute across every stage:

Smarter Acquisition: Data-driven customer lifecycle management prioritizes high-intent prospects, lowering CPA and shortening sales cycles.

- Faster Conversions: Automated workflows, real-time calling, and lifecycle-based follow-ups remove friction at the moment decisions are made.

- Stronger Retention: CLM software surfaces churn risk early and triggers proactive engagement before revenue is lost.

- Scalable Growth: Automated customer lifecycle management platforms support volume without sacrificing personalization.

- Predictable Revenue: Clear lifecycle visibility connects pipeline activity, contract lifecycle management, and customer success into one system.

If you're ready to operationalize customer lifecycle management with real-time calling, SMS, automation, and full pipeline visibility, Ringy provides the foundation to manage every lifecycle stage, from first touch to long-term loyalty, without adding complexity.

Skyrocket your sales with the CRM that does it all.

Calling? Check. SMS? Check. Automation and AI? Check. Effortlessly keep in touch with your customers and boost your revenue without limits.

Take your sales to new heights with Ringy.

Sales in a slump? Ringy gives you the tools and flexibility you need to capture leads, engage with them, and turn them into customers.

Subscribe to Our Blog

Enter your email to get the latest updates sent straight to your inbox!

Categories

Related Articles