Understanding Churn Rate: Meaning, Formula, and Benchmarks

Updated on

Updated on

By Carlos Correa

By Carlos Correa

Carlos Correa

Carlos has been involved in the sales space for well over ten years. He began in the insurance space as an individual sales agent, managing teams as s...

learn more

Carlos Correa

Carlos has been involved in the sales space for well over ten years. He began in the insurance space as an individual sales agent, managing teams as s...

Table of Contents

Table of Contents

No matter how great your product is, customers leaving your business is inevitable. The real question is, how often is it happening, and what's that telling you?

That's where churn rate comes in.

Churn rate can reveal blind spots in your customer experience, signal issues in your onboarding process, and ultimately, show whether your business is truly retaining value or bleeding it out.

For SaaS companies, especially, tracking churn rate is essential. Since recurring revenue models depend heavily on long-term customer relationships, even a small uptick in churn can snowball into major losses.

That's why smart companies use churn rate as a guiding light for everything from customer success strategies to pricing experiments.

In this article, you'll learn what churn rate really means, how to calculate it (with easy-to-follow formulas), what qualifies as a “good” churn rate in SaaS, and how platforms like Ringy help teams reduce churn while keeping customer communication on point.

What is Churn Rate?

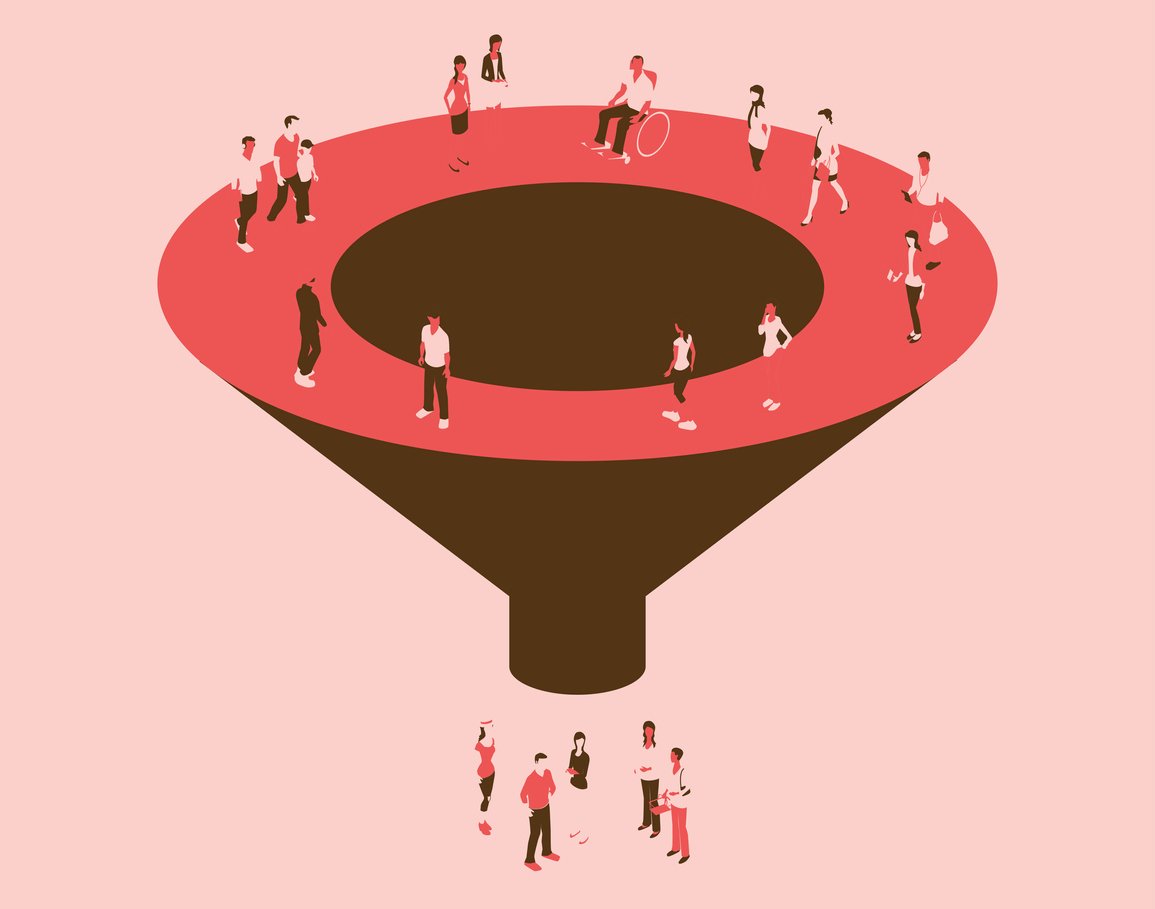

Churn rate is the percentage of customers who stop using a product or service over a specific period.

It's a key metric for businesses to measure customer retention. A high churn rate signals dissatisfaction or better alternatives elsewhere, prompting companies to improve service quality or customer engagement strategies to retain users.

What is a Churn Rate in Simple Terms?

In the simplest terms, churn rate tells you how many of your customers decided to walk away.

For example, if 10 out of 100 customers cancel their subscriptions in a month, your churn rate is 10%. That means for every 10 customers you gain, you'll need to find 10 more just to break even. This is why keeping churn low is just as important as acquiring new users—if not more.

Tools like Ringy help reduce churn by improving your outreach and customer communication. Its CRM features help you stay connected and respond quickly, increasing the likelihood that customers stick around.

Difference Between Churn Rate and Retention Rate

Churn rate and retention rate are two sides of the same coin, but they tell very different stories. Churn rate shows the percentage of customers lost, while retention rate shows the percentage of customers you've successfully kept.

Here's how they compare:

- Churn Rate = % of customers lost over a period

- Retention Rate = % of customers retained over the same period

If your churn rate is 20%, your retention rate is 80%. Simple math—but the implications go much deeper. A rising churn rate may indicate customer dissatisfaction, poor onboarding, or lack of perceived value. In contrast, a high retention rate suggests strong customer loyalty and a well-performing product or service.

When using a CRM system, you can track customer interactions, identify potential drop-off points, and create automated nurturing flows to boost retention and drive that churn number down.

Why Churn Rate Matters

Your churn rate is a window into the health of your business. Knowing how many customers leave (and why) gives you a serious edge. If you're not tracking churn, you're essentially driving with your eyes closed.

Whether you're running a SaaS platform, a subscription box, or a service-based business, churn affects everything from revenue forecasts to product decisions.

1. Impact on Revenue and Growth

A high churn rate hits your bottom line like a wrecking ball.

Every customer you lose is future revenue walking out the door. For SaaS companies especially, recurring revenue depends heavily on keeping customers subscribed and engaged.

According to industry benchmarks, the average churn rate for SaaS businesses ranges from 5% to 7% annually for enterprise-level platforms—but can climb much higher for startups and smaller services.

Let's say you acquire 100 new customers a month but lose 30 due to churn. You're constantly running in place, spending more on acquisition just to stay afloat. On the flip side, if you reduce churn by even a few percentage points, you can dramatically boost customer lifetime value (CLV)—and that means healthier, more sustainable growth.

2. Insight into Customer Satisfaction

Your churn rate is a loud, flashing signal that something may not be working. Are customers unhappy with your onboarding? Is your product not delivering the promised value? Are support tickets going unanswered?

Digging into churn gives you insight into customer satisfaction (or lack thereof). If churn is climbing, it's time to ask the hard questions:

- Are customers confused or frustrated?

- Are they not seeing ROI?

- Are competitors offering better features or support?

A spike in customer churn rate might reveal issues you didn't even know existed. The key is to act on the data. Use churn as a diagnostic tool—not just a post-mortem.

Ringy makes this easier by giving you a full view of the customer journey. You can track every interaction, flag accounts showing signs of disengagement, and deploy tailored messages that re-engage users before they ghost you.

3. Strategic Decisions Driven by Churn Analysis

Analyzing churn should guide your strategy. When you understand why people leave, you can make smarter, more targeted improvements across the board.

For example:

- High monthly churn rate? Maybe your onboarding flow needs an overhaul.

- Losing enterprise accounts? You might need better account management or custom solutions.

- Dropping off after free trials? Consider enhancing your value proposition or tweaking your pricing.

Churn data helps you prioritize what actually matters. It pushes you to build better products, invest in customer success, and improve the overall experience. It's not just about keeping customers—it's about learning from them.

How to Calculate Churn Rate

Knowing your churn rate is like having a fitness tracker for your business; it shows whether you're in good shape or slowly losing steam.

Calculating it isn't complicated, but doing it right ensures you get a clear picture of what's really going on with your customers or revenue.

Churn Rate Formula Explained

The basic churn rate formula looks like this:

Churn Rate = (Customers Lost During a Period ÷ Total Customers at the Start of the Period) × 100

Let's say you had 1,000 customers at the beginning of the month and 950 at the end. You lost 50 customers.

Churn Rate = (50 ÷ 1,000) × 100 = 5%

That's your monthly churn rate. You can adapt this formula to calculate annual churn rate, quarterly churn, or even weekly churn, depending on your business model. The key is consistency in the time frame you're tracking.

If you want to get fancy, especially in SaaS or subscription models, you might also track revenue churn rate, which focuses on lost revenue instead of just customer count. (More on that in a bit.)

Step-by-Step Guide: How to Calculate Churn Rate

Here's a quick, no-nonsense guide to calculating churn rate accurately:

- Pick your period: Monthly, quarterly, or annually—whatever suits your business cycle.

- Count the customers at the start: Get the total number of active customers at the beginning of that period.

- Track how many customers left: Only count those who canceled, didn't renew, or otherwise exited.

- Apply the formula: (Customers Lost During a Period ÷ Total Customers at the Start of the Period) × 100

- Analyze the result: Is your churn higher than your industry benchmark? (For SaaS, under 5% monthly is often considered healthy.)

The real value comes not just from calculating churn, but from doing it regularly and acting on what it tells you.

Types of Churn Rates

Knowing which type of churn rate you're measuring helps you take the right action. There's a big difference between losing a small client and losing your highest-paying account.

Let's break down the major types.

1. Customer Churn Rate vs Revenue Churn

Customer churn rate measures the number of customers lost, while revenue churn rate focuses on the dollar value of the revenue lost.

Here's how they differ:

|

Churn Rate Type |

Description |

|

Customer Churn Rate |

|

|

Revenue Churn Rate |

|

For example, if you lose 10 customers who each pay $10/month vs. one client who pays $1,000/month, your customer churn is higher in the first scenario, but your revenue churn hits harder in the second.

2. Voluntary vs Involuntary Churn

Another important distinction is why your customers are churning. Some leave by choice, others due to avoidable technical issues.

This is how you tell:

|

Type of Churn |

Definition |

Examples |

Fixability |

|

Voluntary |

When customers actively choose to cancel a service |

Canceling due to price, switching to a competitor |

Requires strategy + support |

|

Involuntary Churn |

When customers leave unintentionally |

Failed payments, expired cards, system errors |

Often fixed with automation |

Voluntary churn often signals dissatisfaction, your product isn't meeting expectations, your support is lacking, or a competitor has a better offer. Involuntary churn, on the other hand, is usually preventable with smart systems in place.

Ringy helps reduce both by keeping customer interactions warm and consistent. You can send timely reminders, follow up with at-risk users, and automate key communications—all of which are crucial to cutting churn at the source.

SaaS Churn Rate

Again, because SaaS businesses depend on recurring revenue, even a slightly high churn rate can slow growth, burn cash, and spook investors. Let's explain why.

Importance of Churn Metrics for SaaS Companies

SaaS churn rate metrics are essential because they allow you to measure not just how many customers are leaving, but how much revenue you're losing over time. This helps forecast future growth, plan marketing budgets, and refine onboarding strategies.

A low churn rate indicates that users are getting value from your product, staying engaged, and are likely to become long-term customers. On the other hand, a rising customer churn rate or revenue churn rate is a clear sign that something's off, whether that's product performance, user experience, or customer service.

That's where platforms like Ringy come into play. With features like pipeline tracking, lead follow-up automation, and contact segmentation, Ringy helps SaaS companies nurture relationships that last beyond the free trial.

Unique Challenges in SaaS Churn Management

Managing churn in SaaS isn't a set-it-and-forget-it task. It's a full-time balancing act. Here's what makes it particularly tricky:

- Low switching costs: SaaS customers can leave with a few clicks. If they find a better deal or smoother UX elsewhere, they're gone.

- Free trials and freemium models: These can inflate churn if users don't convert or stick around post-trial.

- Scaling support: As your customer base grows, maintaining quality support becomes tougher—yet it's critical for retention.

- Product misalignment: When users realize your tool doesn't meet their specific needs, they churn. Fast.

SaaS churn management requires constant engagement. You need onboarding that educates, customer support that delights, and product updates that prove value consistently.

SaaS Churn Rate Benchmarks

Before you panic about your churn rate, it helps to know what's “normal” in your space. Churn benchmarks vary widely depending on company size, target market, and industry vertical.

Average SaaS Churn Rates by Company Size or Industry

Here's a look at typical churn rates across different SaaS environments:

|

Company Size / Industry |

Average Monthly Churn Rate |

Average Annual Churn Rate |

|

Small Businesses (SMBs) |

3% – 7% |

20% – 30% |

|

Mid-sized Companies |

1% – 4% |

10% – 20% |

|

Large Enterprises |

<1% – 2% |

5% – 10% |

|

B2C SaaS (e.g., streaming apps) |

7% – 15% |

40% – 60% |

|

B2B SaaS (e.g., CRMs, project management) |

1% – 5% |

10% – 25% |

What is a Good Churn Rate?

Determining a "good" churn rate isn't a one-size-fits-all scenario. It varies based on industry, company size, and customer base. However, understanding industry benchmarks and the factors influencing churn can help you set realistic goals and strategies.

Ideal Benchmarks by Industry

Here's a snapshot of average churn rates across various industries:

|

Industry |

Average Monthly Churn Rate |

Average Annual Churn Rate |

|

B2B SaaS |

10% – 25% |

|

|

B2C SaaS |

7% – 15% |

40% – 60% |

|

Telecommunications |

1.9% – 2.2% |

|

|

Retail |

5% – 7% |

30% – 60% |

|

Banking and Finance |

6% – 18% |

|

|

Healthcare |

1% – 2% |

12% – 24% |

Note: These figures are approximate and can vary based on specific market conditions and company practices.

It's crucial to align your business with these SaaS churn rate benchmarks to ensure retention strategies are on point and customer satisfaction stays high.

Factors that Influence What is Considered "Good"

Several elements can influence what constitutes a "good" churn rate for your business:

- Business Model: Subscription-based models may tolerate higher churn due to recurring revenue streams, whereas one-time purchase models aim for minimal churn.

- Customer Acquisition Cost (CAC): If acquiring customers is expensive, a lower churn rate is crucial to ensure profitability.

- Customer Lifetime Value (CLV): A higher CLV can offset a higher churn rate, but ideally, both metrics should be optimized.

- Market Maturity: In emerging markets, higher churn might be acceptable due to rapid growth and experimentation. In mature markets, lower churn is expected.

- Product Complexity: Complex products may have higher initial churn due to a steep learning curve, emphasizing the need for effective onboarding.

Understanding these factors helps in setting realistic churn rate targets and developing strategies to achieve them.

Causes of High Churn Rates

Identifying the root causes of high churn rates is essential for implementing effective retention strategies. Here are some common culprits:

Poor Onboarding

First impressions matter. A lackluster onboarding experience can leave customers confused and disengaged. In fact, poor onboarding accounts for approximately 23% of customer churn.

Solution: Implement a structured onboarding process that guides users through initial setup, highlights key features, and provides resources for continued learning.

Lack of Product Fit

If your product doesn't align with customer needs or expectations, they're likely to churn. This misalignment often stems from targeting the wrong audience or overpromising features.

Solution: Clearly define your ideal customer profile and tailor your marketing and sales efforts to attract and retain this segment.

Pricing Issues

Price sensitivity can lead customers to seek alternatives. If they perceive your product as overpriced relative to its value, churn increases.

Solution: Regularly assess your pricing strategy to ensure it reflects the value provided and remains competitive within the market.

Competitor Switching

Customers may leave if competitors offer better features, pricing, or customer service. This is especially prevalent in markets with low switching costs.

Solution: Continuously innovate and gather customer feedback to enhance your product offerings and customer experience, making it harder for competitors to lure your customers away.

How to Reduce Customer Churn Rate

Reducing the customer churn rate is key to maintaining a loyal client base. By implementing strategic approaches, businesses can retain valuable customers and improve long-term success and profitability.

Here are some of the ways you can reduce customer churn rate in your Saas business.

Actionable strategies

To reduce customer churn, implement actionable strategies that focus on building long-term relationships. These strategies include the following:

1. Improve Customer Support

When customers feel heard and their issues are resolved promptly, they're more likely to stay. Implementing live chat support, comprehensive FAQs, and responsive email support can make a significant difference.

Additionally, training your support team to handle inquiries empathetically and efficiently ensures a positive customer experience.

2. Enhance Onboarding Experience

A smooth onboarding process helps customers understand and derive value from your product quickly. Utilize interactive tutorials, welcome emails, and personalized setup assistance to guide new users.

By ensuring customers achieve their first success early, you increase the likelihood of long-term retention.

3. Regular Check-ins and Surveys

Maintaining open lines of communication allows you to gather feedback and address concerns proactively. Regular check-ins, whether through emails or calls, show customers that you value their input.

Surveys can provide insights into customer satisfaction and areas for improvement. Acting on this feedback demonstrates a commitment to their success.

4. Incentivize Loyalty

Rewarding customers for their continued patronage fosters loyalty. Implement loyalty programs, offer exclusive discounts, or provide early access to new features. These incentives not only show appreciation but also encourage customers to remain engaged with your brand.

5. Tools and Platforms to Help Monitor Churn

Monitoring churn requires the right sales tools to gather and analyze data effectively. Consider the following platforms:

- HubSpot Service Hub: Offers comprehensive customer service tools, including ticketing and customer feedback features.

- Zendesk: Provides a robust support ticket system and customer engagement analytics.

- Intercom: Combines live chat, bots, and customer data to facilitate proactive support.

- ChurnZero: Specializes in customer success management, helping identify at-risk customers and automate engagement.

- Baremetrics: Delivers subscription analytics and insights into metrics like MRR and churn rate.

Utilizing these tools can provide a clearer picture of customer behavior and help in crafting strategies to reduce churn.

Churn Rate Calculation Tips and Common Mistakes

Accurate calculation of your churn rate is crucial for understanding customer retention and making informed business decisions. Let's look at the best practices and common pitfalls.

Tips for Accurate Tracking

Accurately calculating churn rate is essential for understanding customer retention. Here are some tips to ensure your tracking stays precise:

- Define the Period Clearly: Determine whether you're calculating churn monthly, quarterly, or annually. Consistency in time frames ensures comparability over periods.

- Use the Correct Formula: The standard churn rate formula is: Churn Rate = (Number of Customers Lost During Period) / (Number of Customers at Start of Period) x 100

- Segment Your Customers: Analyzing churn by customer segments (e.g., by industry, subscription plan, or geography) can reveal specific areas needing attention.

- Incorporate Revenue Churn: Beyond customer count, assess revenue churn to understand the financial impact of lost customers. This includes considering downgrades and cancellations.

Common Errors and How to Avoid Them

Missteps in churn rate calculation can lead to misleading insights. Here are the most common mistakes and how to fix them:

- Ignoring Seasonality: Failing to account for seasonal trends can misrepresent churn rates. Analyze data over comparable periods to identify true patterns.

- Overlooking Involuntary Churn: Customers may churn due to failed payments or technical issues. Implement measures to address these preventable losses.

- Not Differentiating Between Gross and Net Churn: Gross churn accounts for total losses, while net churn considers new customer gains. Understanding both provides a complete picture.

- Neglecting Data Accuracy: Ensure your customer data is up-to-date and accurate. Inaccurate data can lead to misleading churn calculations.

By adhering to these tips and avoiding common mistakes, you can accurately assess your churn rate and implement strategies to enhance customer retention.

Final Thoughts: Mastering Churn Rate for Sustainable Growth

Understanding and managing your churn rate is about nurturing relationships and ensuring your business thrives. A high churn rate can signal underlying issues in customer satisfaction, product fit, or service quality, all of which directly impact your revenue and growth potential.

Regularly monitoring churn provides invaluable insights into your customers' experiences and expectations. By analyzing churn patterns, businesses can identify at-risk customers and implement targeted strategies to enhance retention.

But insights alone aren't enough. Acting on churn data is crucial. Implementing real-time monitoring systems and fostering cross-functional collaboration can help address churn proactively, ensuring that customers remain engaged and satisfied.

Ringy CRM offers robust tools to monitor customer interactions, gather feedback, and automate engagement strategies. With Ringy, you can transform churn insights into actionable strategies, fostering long-term customer loyalty and driving sustainable growth.

Start your journey towards better customer retention by requesting a Ringy demo today.

Skyrocket your sales with the CRM that does it all.

Calling? Check. SMS? Check. Automation and AI? Check. Effortlessly keep in touch with your customers and boost your revenue without limits.

Take your sales to new heights with Ringy.

Sales in a slump? Ringy gives you the tools and flexibility you need to capture leads, engage with them, and turn them into customers.

Subscribe to Our Blog

Enter your email to get the latest updates sent straight to your inbox!

Categories

Related Articles